Table of Contents

ToggleUnderstanding the New vs Old Tax Regime:

Taxes – a word that can often evoke mixed emotions. While they are essential for the functioning of a country, understanding and managing them can be complex. In India, taxpayers have the option to choose between the New and Old tax regimes, each with its own set of benefits and considerations. Recently, the need to switch from the New to the Old tax regime has become pertinent, requiring taxpayers to fill Form 10-IEA by a specified deadline. Let’s delve into the intricacies of this transition and how taxpayers can navigate through it.

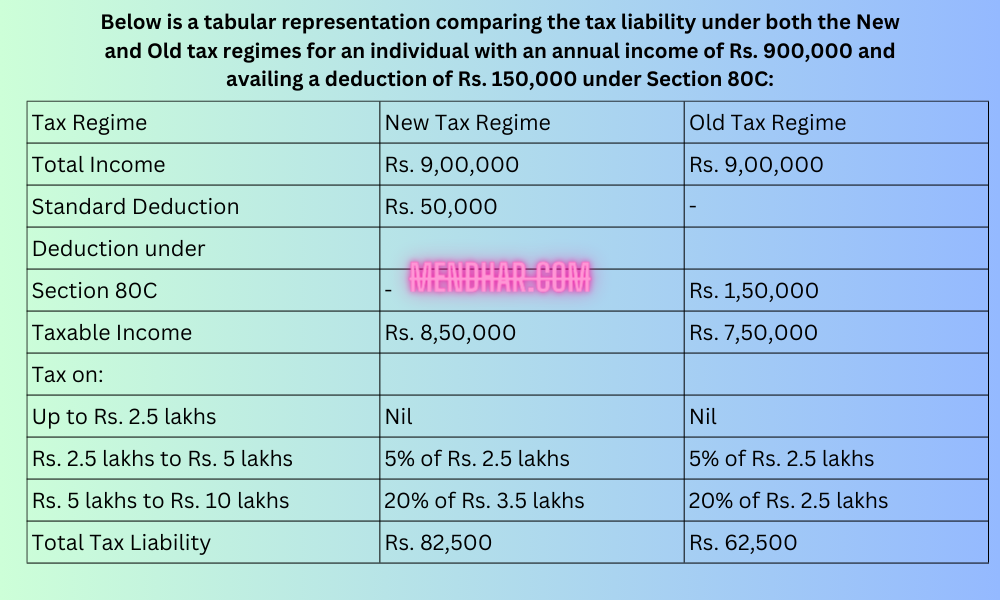

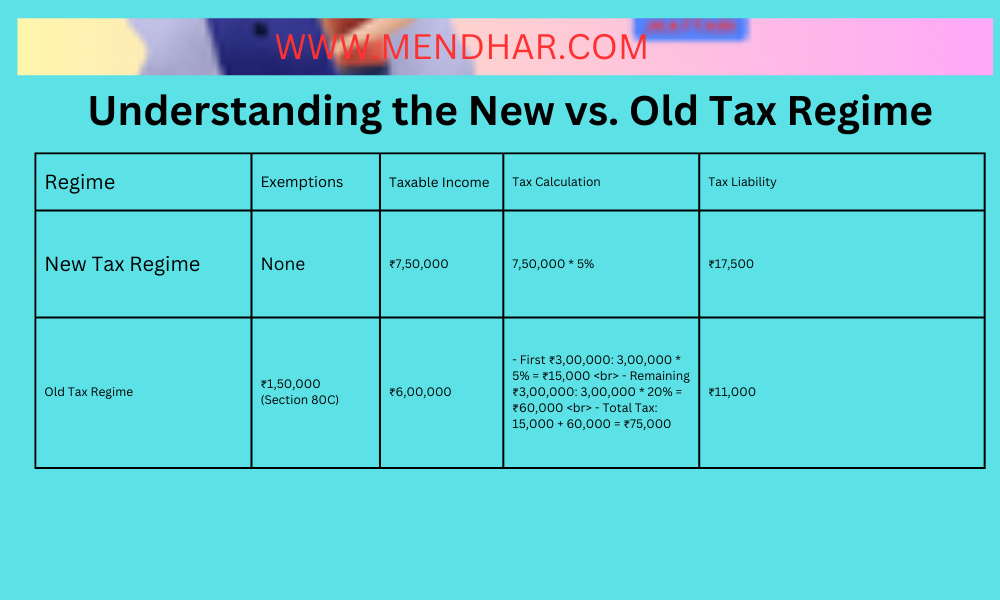

Understanding the New vs Old Tax Regime: with examples

Before we dive into the specifics of the transition, it’s crucial to understand the fundamental differences between the New and Old tax regimes in India.

The New Tax Regime: Introduced in the Union Budget 2020, the New tax regime offers lower tax rates but comes with the trade-off of foregoing certain tax deductions and exemptions. It aims to simplify the tax structure and reduce the tax burden on individuals.

The Old Tax Regime: The Old tax regime follows the traditional tax structure with higher tax rates but allows for various deductions and exemptions under different sections of the Income Tax Act. This regime provides more avenues for taxpayers to reduce their taxable income.

New Tax Regime (NTR):

- Lower tax rates: Offers lower tax slabs compared to the OTR.

- Limited deductions and exemptions: Eliminates most deductions and exemptions traditionally available under the OTR.

- Standard deduction: Provides a standard deduction of ₹50,000, eliminating the need for itemized deductions.

Old Tax Regime (OTR):

- Higher tax rates: Features higher tax slabs compared to the NTR.

- Wide range of deductions and exemptions: Allows claiming numerous deductions and exemptions, potentially reducing your taxable income.

- No standard deduction: Requires itemizing deductions to claim the benefit.

Tax Benefit Comparison: New vs. Old Tax Regime (Example)

Assumptions:

- Income: ₹5,00,000 per year

- Investments:

- Equity Linked Saving Scheme (ELSS): ₹1,50,000

- Public Provident Fund (PPF): ₹1,00,000

- Health Insurance Premium: ₹30,000

- Other deductions (if applicable in OTR):

- House Rent Allowance (HRA): ₹75,000

- Leave Travel Allowance (LTA): ₹30,000

- Professional Tax: ₹10,000

Switching from New to Old Tax Regime:

While the New tax regime may seem appealing due to lower tax rates, some taxpayers may find themselves in a situation where switching to the Old tax regime becomes beneficial. This could be due to changes in financial circumstances, such as increased tax-saving investments or the availability of deductions that are not applicable under the New regime.

Why switch back to the OTR?

Despite the lower tax rates in the NTR, some individuals might benefit more from the OTR due to:

- High investments and expenses: Those with significant investments in tax-saving instruments or incurring eligible deductions under the OTR might find their tax liability lower.

- Complex income sources: Individuals with income from various sources, including business or professional income, might find calculations simpler under the OTR.

- Uncertainty about future income: If your income is variable, the OTR’s flexibility with deductions might be more advantageous.

Filling Form 10-IEA: Form 10-IEA is a crucial document for taxpayers looking to switch from the New to the Old tax regime. It serves as a declaration of intent to opt for the Old tax regime and must be filed within the specified deadline to avail of the benefits under the Old regime.

Introduced in FY 23-24, Form 10-IEA allows individuals with business or professional income to opt out of the NTR and switch back to the OTR. Remember, this option is only available for FY 23-24, and once exercised, you cannot revert to the NTR in the future.

Key points to remember about Form 10-IEA:

- Filing deadline: July 31, 2024. Missing this date will lock you into the NTR for the entire FY 23-24.

- Eligibility: Primarily for individuals with business or professional income. Salaried individuals can also opt out at the time of filing their income tax return.

- Filing method: Electronic filing is mandatory, either through a digital signature or an electronic verification code (EVC).

- Impact on tax deducted at source (TDS): If you switch to the OTR, inform your employer or income source provider to adjust the TDS accordingly.

Frequently Asked Questions (FAQ) - Switching from New to Old Tax Regime and Filling Form 10-IEA

What is Form 10-IEA, and why is it important?

- Form 10-IEA is a declaration form used by taxpayers in India to switch from the New tax regime to the Old tax regime. It is essential for individuals who wish to avail deductions and exemptions not available under the New regime.

Who is eligible to switch from the New to the Old tax regime?

- Any individual taxpayer in India who is currently under the New tax regime and wishes to switch to the Old tax regime can do so by filling out Form 10-IEA. However, it’s crucial to evaluate whether switching regimes is beneficial based on individual financial circumstances.

What are the key differences between the New and Old tax regimes?

- The New tax regime offers lower tax rates but does not allow for various deductions and exemptions available under the Old regime. On the other hand, the Old tax regime follows traditional tax rates but provides avenues for taxpayers to reduce their taxable income through deductions and exemptions.

How can I determine if switching to the Old tax regime is beneficial for me?

- It’s advisable to consult with tax professionals or financial advisors to evaluate the impact of switching tax regimes based on your specific financial situation. They can assess factors such as income, deductions, exemptions, and tax liabilities to help you make an informed decision.

What documents are required to fill out Form 10-IEA?

- Taxpayers need to gather relevant documents, including investment proofs, salary slips, bank statements, and any other documents related to deductions or exemptions claimed under the Old tax regime. These documents may be required as supporting evidence during the filing process.

Incredible news! We’ve discovered a game-changing tool to enhance your SMM and reCAPTCHA challenges.

By utilizing our selfhosted IPv6 proxy, you’ll benefit from:

Addressing Google reCAPTCHA v2 and v3 challenges with ease.

Accessing an extensive array of unique IP addresses through IPv6 proxies, ensuring seamless navigation through bot protection systems.

Improving security and privacy while bypassing restrictions imposed by bot protection mechanisms.

Don’t let reCAPTCHA challenges hold you back. Contact us now to get started with our IPv6 proxy solution!

https://listings.surge.sh/posts/proxy-v6/

Pingback: Income Tax Returns 2024: Old or New Tax Regime? Which has more benefit? - Mendhar.com

Pingback: Income Tax Return: Which Tax Regime I should choose for FY 2023-24? - Mendhar.com

Pingback: Important Dates of ITR Filing FY 2023-24 (AY 2024-25) -

Fantastic

Informative

Pingback: Old Pension Scheme Latest New -

Pingback: Government Employees Get DA Hike -