Table of Contents

ToggleSubmitting Income Tax Returns 2024: Old or New Tax Regime? Which Holds More Benefits?

Income Tax Returns 2024:which regime has more benefit?

As another tax season rolls around, taxpayers are faced with the imperishable dilemma should they stick with the familiar old duty governance or adventure into the uncharted home of the new governance? With the geography of duty laws constantly evolving, it’s pivotal to estimate which governance offers further advantages for individualities filing their income duty returns in 2024.

Handling the complex nature of income duty forms can constantly act making together a complicated mystification. This mystification is further complicated by the options between the old and new duty administrations. Let’s examine the specifics of each governance in further detail to see which one stylish suits your requirements and fiscal objects.

Old Tax System: A well known-route

The maturity of taxpayers are familiar with the structure of the former duty system, which was put in place numerous times agone. With the help of its multitudinous immunity and deductions, people can drastically lower their taxable income. Taxpayers may abate some costs under this system, including interest paid on home loans, health insurance decorations, and investments made in Public Provident finances( PPF) and Equity Linked Savings Schemes( ELSS)

Benefits of Old Tax Regime:-

Deductions and Immunity: The plethora of deductions available under the old governance provides taxpayers with openings to lower their duty liability mainly.

Familiarity: Numerous taxpayers prefer the old governance due to its familiarity and the comfort of navigating through its well- established vittles.

Acclimatized for Specific Circumstances individualities with specific fiscal situations, similar as those with home loans or high medical charges, may find the old governance more salutary due to the vacuity of applicable deductions.

New Tax Regime: Charting a Different Course

Income Tax Returns 2024: Old or New Tax Regime? Which has more benefit?

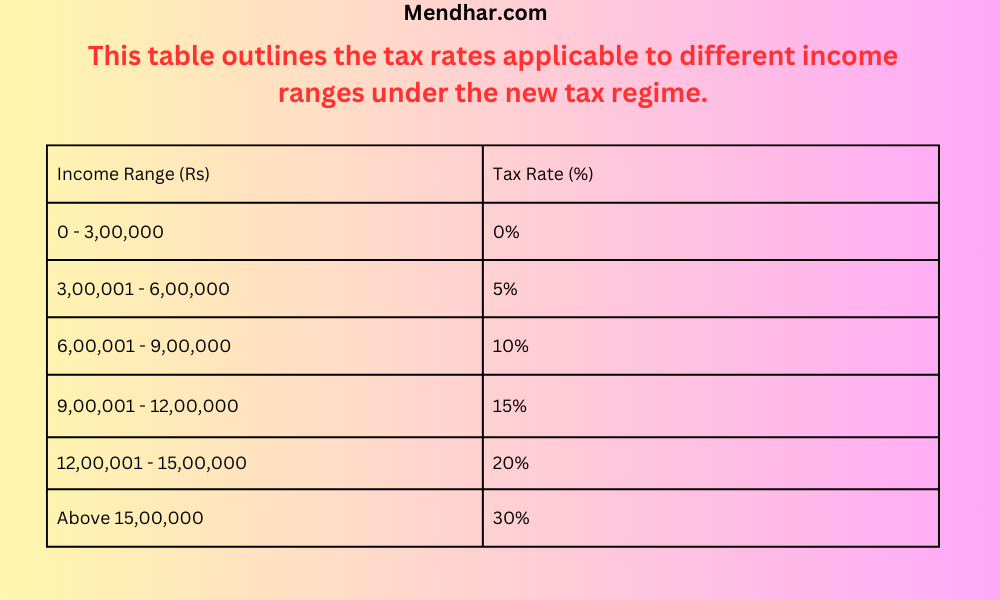

Introduced in recent times, the new duty governance aims to simplify the duty structure by offering lower duty rates while barring most deductions and immunity. Under this governance, taxpayers are subject to lower duty rates grounded on their income crossbeams, with no option to claim deductions for colorful charges.

Benefits of the New Tax Regime:

- Lower Tax Rates: The new duty governance offers reduced duty rates across different income crossbeams, potentially performing in lower duty exoduses for numerous taxpayers.

- Simplified Structure: By barring deductions and immunity, the new governance simplifies the duty-form process, making it less clumsy for individualities with straightforward fiscal situations.

- No Attestation Hassles: With smaller deductions to track and document, taxpayers under the new governance may witness lower paperwork and executive burden during duty form.

Which Regime Holds More Benefits for 2024?

Which Regime Holds More Benefits for 2024?

The answer to this question largely depends on individual circumstances. Taxpayers with significant investments and charges that qualify for deductions may find the old governance more profitable. On the other hand, individualities with fairly straightforward fiscal biographies and moderate to high-income situations might profit further from the lower duty rates offered by the new governance. The choice between the old and new duty administrations in India depends heavily on individual circumstances, and it’s important to consider several factors before making a decision. Then’s a breakdown of some crucial points.

Old Tax Regime:

. Advantages: Offers a wider range of deductions and immunity, potentially leading to lower duty liability for those with significant investments, charges, and claims.

. Disadvantages: More complex paperwork and computations due to the multitudinous deductions, taking scrupulous record-keeping.

3. Suitable for : Taxpayers with high income and different investments who can maximize deductions, tone-employed individualities, and those with specific charges covered under immunity.

New Tax Regime:

- Advantages: Simpler form process with smaller deductions and immunity, performing in easier duty computation and form. Lower duty rates compared to the old governance for specific income classes

- Disadvantages: Limited deductions and immunity, which might not be suitable for those with significant investments or charges that qualify for duty benefits

- Suitable for: For Salaried individualities with moderate to high-income situations who don’t have numerous deductions or claim too numerous immunity, elderly citizens with interest income covered under Section 80TTB, and individualities who prefer a simpler form process

Flash back, this is just a general overview. It’s pivotal to consult with a duty professional who can dissect your specific income, investments, charges, and fiscal pretensions to recommend the most suitable duty governance for you. They can also help you with the computations and form process. As you gear up to file your income duty returns for 2024, precisely estimate your fiscal situation and consider the counteraccusations of choosing between the old and new duty administrations. While the old governance offers a familiar geography with ample deductions, the new governance provides simplicity and potentially lower duty rates. Eventually, the choice between the two hinges on maximizing duty benefits while aligning with your long- term fiscal pretensions. So, weigh your options wisely and embark on this duty- form trip armed with knowledge and foresight.

Frequently Asked Questions (FAQ) - Income Tax Returns 2024: Old or New Tax Regime

- What are the main differences between the old and new tax regimes?

- The old duty governance allows for colorful deductions and immunity, reducing taxable income significantly. In discrepancy, the new duty governance offers lower duty rates but eliminates most deductions and immunity.

- Which tax regime should I choose for filing my income tax returns in 2024?

- The choice between the old and new tax regimes depends on your individual financial situation. If you have significant investments and expenses eligible for deductions, the old regime might be more beneficial. However, if you prefer simplicity and lower tax rates, the new regime could be a better fit.

- What deductions and exemptions are available under the old tax regime?

- Deductions and exemptions under the old tax regime include expenses such as home loan interest, medical insurance premiums, and investments in specified instruments like Public Provident Fund (PPF) and Equity Linked Savings Scheme (ELSS).

- Are there any drawbacks to the old tax regime?

- While the old tax regime offers various deductions, it might result in a higher tax liability compared to the new regime for individuals with straightforward financial situations and moderate to high income levels.

- Will I need to maintain extensive documentation for deductions under the old tax regime?

- Yes, claiming deductions under the old tax regime requires proper documentation of expenses and investments to support your tax return.

- How can I determine which tax regime is more beneficial for me?

- You can evaluate the benefits of both tax regimes based on your financial goals, income level, and eligibility for deductions. Consulting with a tax advisor can also provide personalized guidance tailored to your specific circumstances.

- Can I switch between tax regimes from year to year?

- Yes, taxpayers have the flexibility to switch between the old and new tax regimes each year based on their preferences and financial situation. However, it’s essential to carefully consider the implications of switching and assess which regime aligns better with your current needs.

Pingback: The Electric Lunch Box - buy-products.in

Pingback: Income Tax Return: Which Tax Regime I should choose for FY 2023-24? - Mendhar.com

Pingback: Important Dates of ITR Filing FY 2023-24 (AY 2024-25) -

Pingback: Income Tax dept. to act against J&K govt. employees for false refund claims -