Table of Contents

ToggleIncome Tax Slabs for FY 2023-24: A Comprehensive Guide

Table of Content:

- Quick glance at the latest Income Tax Slabs for FY 2023-24

- What is the Income Tax Slab?

- Let’s better understand the Income Tax slabs under Union Budget 2023.

- Comparison of Tax Rates under New Tax Regime and Old Tax Regime for FY 2023-24 (AY 2024-25)

- Important Points to Consider When Selecting the New Tax Regime

- Example of Old Tax Regime vs. New Tax Regime

- Frequently Asked Questions (FAQ)

1. Quick glance at the latest Income Tax Slabs for FY 2023-24

The Income Tax slabs for the Financial Year (FY) 2023-24, as announced in the Union Budget 2024, are as follows:

| Income Range | Tax Rate |

|---|---|

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001 – Rs. 5,00,000 | 5% |

| Rs. 5,00,001 – Rs. 10,00,000 | 10% |

| Rs. 10,00,001 – Rs. 20,00,000 | 20% |

| Above Rs. 20,00,000 | 30% |

2. What is the Income Tax Slab?

The Income Tax Slab is a structure that determines the rate at which individuals, Hindu Undivided Families (HUFs), and other entities are taxed based on their income. It categorizes income into different ranges, with each range having a corresponding tax rate.

Imagine your income as a ladder, and each rung represents a different range of earnings. Now, the government uses this ladder to determine how much tax you need to pay based on which rung your income falls into.

For the fiscal year 2024-25, the income tax slab has been updated to reflect the changing economic landscape. Here’s a simplified version of how it looks:

Basic Exemption: First off, there’s some good news. A certain portion of your income is exempt from tax altogether. This is like a little buffer zone at the bottom of the ladder where you don’t have to worry about paying any tax.

Lowest Bracket: Next, we have the lowest tax bracket. If your income falls within this range, you’ll pay a relatively low tax rate. Think of it as the first few rungs of the ladder where you’re just getting started with paying taxes.

Middle Bracket: As your income climbs higher, you’ll reach the middle tax bracket. Here, the tax rate is a bit higher, but it’s still manageable. It’s like moving up a few more rungs on the ladder where you’re starting to feel the weight of taxes a little more.

Highest Bracket: Finally, we have the highest tax bracket. If you’re earning a significant amount, you’ll fall into this category, where the tax rate is the highest. It’s like reaching the top of the ladder where you’re paying the most taxes, but hopefully, you’re also earning enough to make it worthwhile.

Remember, these tax slabs are designed to ensure that everyone pays their fair share based on their income level. So, while paying taxes might not be the most exciting thing, it’s an important part of contributing to the country’s development and ensuring that essential services are funded for everyone.

That’s a basic overview of the income tax slab for the year 2024-25. If you have any specific questions or need more detailed information, it’s always a good idea to consult with a tax professional who can guide you through the process.

3. Let’s better understand the Income Tax slabs under Union Budget 2023.

The Income Tax slabs for FY 2023-24 remained largely unchanged compared to the previous financial year. The government aims to provide relief to individual taxpayers while ensuring adequate revenue collection to meet its fiscal targets.

4. Comparison of Tax Rates under New Tax Regime and Old Tax Regime for FY 2023-24 (AY 2024-25)

The Union Budget 2023 reduces the number of tax slabs under the new regime. We can compare the current new regime with the proposed new regime as follows:

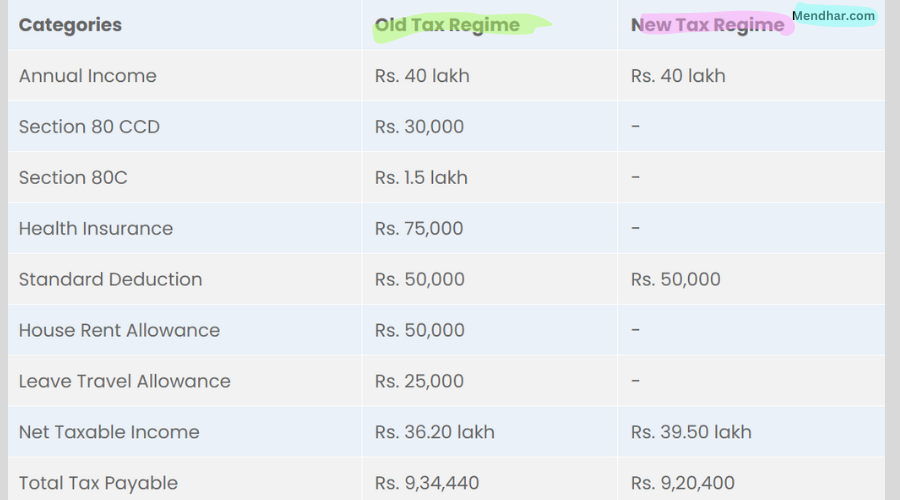

Example of Old Tax Regime vs. New Tax Regime

Let’s quickly review the following example in order to better grasp how taxes are calculated under income tax slabs.

Let’s say that Faiz Attari is an individual taxpayer with a total taxable income of Rs. 40 lakh. This sum has been computed after accounting for all sources of income and required deductions.

Faiz Attari is keen to find out his outstanding taxes after this. Before we get into more detail, there are a few key distinctions between the old and new tax regimes that you should be aware of.

It is thought that people who have less invested in tax-saving plans will benefit more from the new tax system.

For individual taxpayers with qualified investments and costs, the previous income tax slab provides greater tax advantages.

It is advantageous to examine both tax slabs.

Frequently Asked Questions (FAQ)

Q: How is taxable income calculated?

- A: Taxable income is calculated by subtracting allowable deductions and exemptions from gross income.

Q: What are some common deductions available to taxpayers?

- A: Common deductions include those for investments in specified savings schemes (such as Public Provident Fund, Equity Linked Savings Scheme), health insurance premiums, housing loan interest, and contributions to retirement funds.

Q: Can I claim deductions for donations to charitable organizations?

- A: Yes, donations made to eligible charitable organizations are eligible for deduction under Section 80G of the Income Tax Act, subject to specified limits.

Q: Are there any tax benefits available for home loan repayment?

- A: Yes, taxpayers can claim deductions on both the principal repayment (under Section 80C) and interest payment (under Section 24) of a home loan, subject to specified conditions.

- Q: Is there any tax payable on income from investments such as dividends and capital gains?

- A: Yes, income from investments such as dividends, capital gains from the sale of assets, and interest on certain investments may be subject to tax as per applicable tax rates and rules.

Q: Are there any special tax benefits for senior citizens and individuals with disabilities?

- A: Yes, senior citizens and individuals with disabilities are eligible for higher basic exemption limits and additional deductions under specified sections of the Income Tax Act.

Q: Can I carry forward losses incurred in a financial year for set-off against future income?

- A: Yes, certain types of losses such as capital losses and business losses can be carried forward for set-off against future income, subject to specified conditions and limits.

Pingback: Retirement Quotes for Teachers - Mendhar.com

Pingback: Understanding the New Income Tax System: Essential Information - Mendhar.com

Pingback: New Vs Old tax regime: Tax Benefit Comparison - Mendhar.com

Pingback: Income Tax Returns 2024: Old or New Tax Regime? Which has more benefit? - Mendhar.com

informative

Gain very useful information, very beneficial in many cases

Informative

Pingback: How to Opt for the New Tax Regime or Stick with the Old -

Pingback: 26AS:The Complete Guide to Income Tax Returns -