Table of Contents

ToggleMark Your Calendars: Important Dates for ITR Filing in FY 2023-24 (AY 2024-25)

The Indian tax season is approaching, and with it comes the annual ritual of filing Income Tax Returns (ITRs). While the financial year 2023-24 ends on March 31st, 2024, you’ll need to be mindful of specific deadlines for filing your ITR in the corresponding assessment year (AY) 2024-25.

This blog serves as a handy guide for taxpayers, highlighting the crucial dates for ITR filing in the upcoming tax season:

1.Important Dates of ITR Filing FY 2023-24( Standard ITR Filing Deadline: July 31st, 2024)

The most common deadline for individuals, Hindu Undivided Families (HUFs), Association of Persons (AOPs), and Business Income (BOI) taxpayers falls on July 31st, 2024. This applies to individuals with income from salaries, pensions, interest, house property, capital gains (except those from business or profession), and other sources not exceeding Rs. 50 lakh.

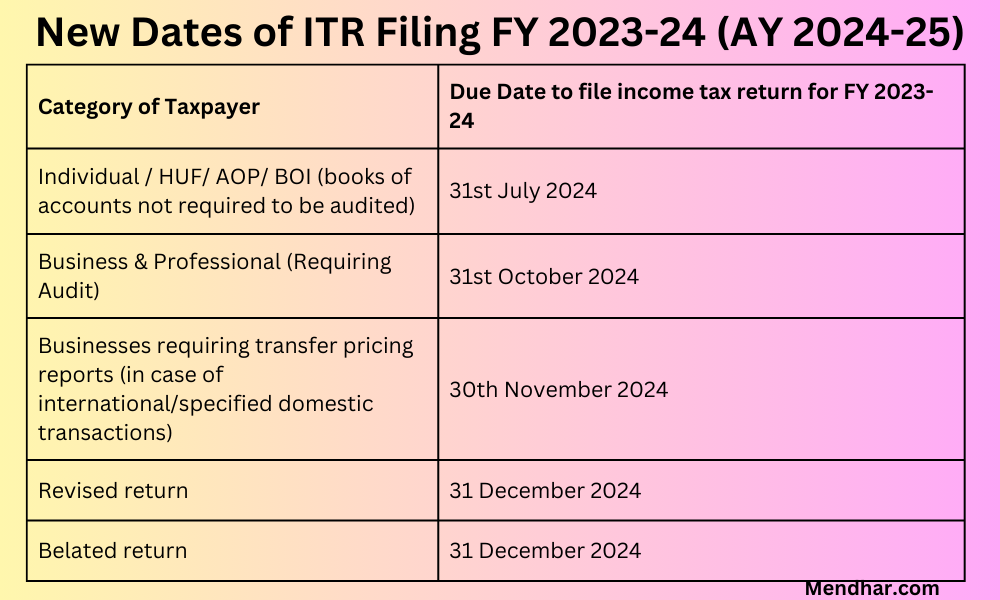

Important Dates of ITR Filing FY 2023-24:-

2. Extended Deadline for Businesses with Tax Audit: October 31st, 2024:

If your business is liable for a tax audit under the Income Tax Act, you’ll be granted an extension for filing your ITR. The deadline for filing your ITR in such cases is October 31st, 2024. However, it’s important to remember that the tax audit report itself needs to be submitted before this date.

3. Due Date for Transfer Pricing Report: November 30th, 2024

This specific deadline applies to taxpayers who are involved in international transactions or specified domestic transactions exceeding the prescribed limit. If you fall under this category, you’ll need to furnish a Transfer Pricing Report to the tax authorities by November 30th, 2024.

4. Revised Return Deadline: December 31st, 2024

In case you discover any errors or omissions in your originally filed ITR, you have the option to submit a revised return. The deadline for filing a revised ITR for AY 2024-25 is December 31st, 2024.

Remember:

- It’s always advisable to file your ITR well before the deadline to avoid any last-minute hassles or potential penalties for late filing.

- The specific ITR form you need to file will depend on your income sources and nature of business.

- The Income Tax Department website provides a wealth of resources and guidance on ITR filing. A tax expert might also be consulted for tailored guidance.

Staying Informed and Prepared:

Keeping yourself informed about the latest ITR filing deadlines and procedures can help ensure a smooth and stress-free tax season. By familiarizing yourself with the key dates and requirements, you can file your ITR accurately and on time, avoiding any unnecessary complications.

Additional Tips:

- Start gathering all your income documents and investment proofs well in advance.

- Choose the appropriate ITR form based on your income sources.

- Utilize online filing options offered by the Income Tax Department for convenience.

- Double-check your ITR for any errors before submission.

By following these guidelines and staying mindful of the deadlines, you can ensure a smooth and compliant tax filing experience in FY 2023-24.

Important Dates of ITR Filing FY 2023-24:CUSTOMER FAQs

1. When is the deadline to file my ITR for the financial year 2023-24 (AY 2024-25)?

The standard deadline for filing your ITR is July 31st, 2024. However, there are extensions available in certain cases.

2. Who needs to file an ITR by July 31st, 2024?

Individuals with income from salaries, pensions, interest, house property, capital gains (except those from business or profession), and other sources not exceeding Rs. 50 lakh need to file by this deadline. This also applies to Hindu Undivided Families (HUFs), Association of Persons (AOPs), and Business Income (BOI) taxpayers.

3. I own a business. Do I have a different deadline?

If your business is liable for a tax audit under the Income Tax Act, you have an extended deadline to file your ITR. The deadline in this case is October 31st, 2024. However, remember that your tax audit report itself needs to be submitted before this date.

4. What if I need to revise my ITR after filing?

You can file a revised ITR if you discover any errors or omissions in your original return. The deadline for filing a revised ITR for AY 2024-25 is December 31st, 2024.

5. Where can I find more information about ITR filing?

The Income Tax Department website provides a wealth of resources and guidance on ITR filing. You can visit their website or consult a tax professional for personalized advice.

6. What are the penalties for late filing of ITR?

Late filing of ITR attracts a penalty as per the Income Tax Act. The penalty amount can vary depending on the delay and your income.

7. Can I file my ITR online?

Yes, the Income Tax Department offers online ITR filing options for your convenience. You can access these options through their website.

8. What documents do I need to file my ITR?

The specific documents you need will depend on your income sources and business nature. Generally, you’ll need income proofs like salary slips, investment statements, bank account statements, and property documents.

9. Is it mandatory to hire a tax professional for ITR filing?

While it’s not mandatory, seeking professional advice can be beneficial if you have complex income sources, require help with tax calculations, or need assistance navigating specific tax situations.

Hey there! mendhar.com

Did you know that it is possible to send request entirely lawfully? We are introducing a new legal way of sending requests through feedback forms.

Due to their importance, messages sent via Communication Forms have less of a chance of ending up as spam.

Come and give our service a try – it’s free!

We are here to send up to 50,000 messages for you.

The cost of sending one million messages is $59.

This message was automatically generated.

We only use chat for communication.

Contact us.

Telegram – https://t.me/FeedbackFormEU

Skype live:contactform_18

WhatsApp – +375259112693

WhatsApp https://wa.me/+375259112693

Pingback: 4% Hike In DA For Central Government Employees -

Pingback: How to Record Students Co-curricular Activities -

Pingback: The National Curriculum Framework (NCF) for the Foundational Stage -

Pingback: Income Tax dept. to act against J&K govt. employees for false refund claims -