Table of Contents

ToggleRecognizing the Modifications to the new Income Tax System:

The Income Tax Department now offers taxpayers two options for filing their Income Tax Returns (ITR) – the Old Tax Regime and the New Tax Regime. This flexibility allows individuals to select the regime that best suits their financial circumstances. It’s important to note that starting from this financial year, the new tax regime will be the default option. However, if you prefer to stick with the old tax regime, you’ll need to explicitly choose that option during filing.

If you’re someone who benefits from income tax exemptions through investment documents, opting for the old tax regime might be advantageous. This is because the new tax regime does not provide deductions for investments.

During the 2023 Budget, the Central Government implemented significant changes to the new tax regime, making income up to Rs 7 lakh tax-free. Additionally, both the old and new tax systems offer a standard deduction benefit of Rs 50,000. Under the new tax slab, individuals with an annual income of up to Rs 7.50 lakh are exempt from paying taxes. However, any income exceeding Rs 7.5 lakh is subject to taxation based on new rates.

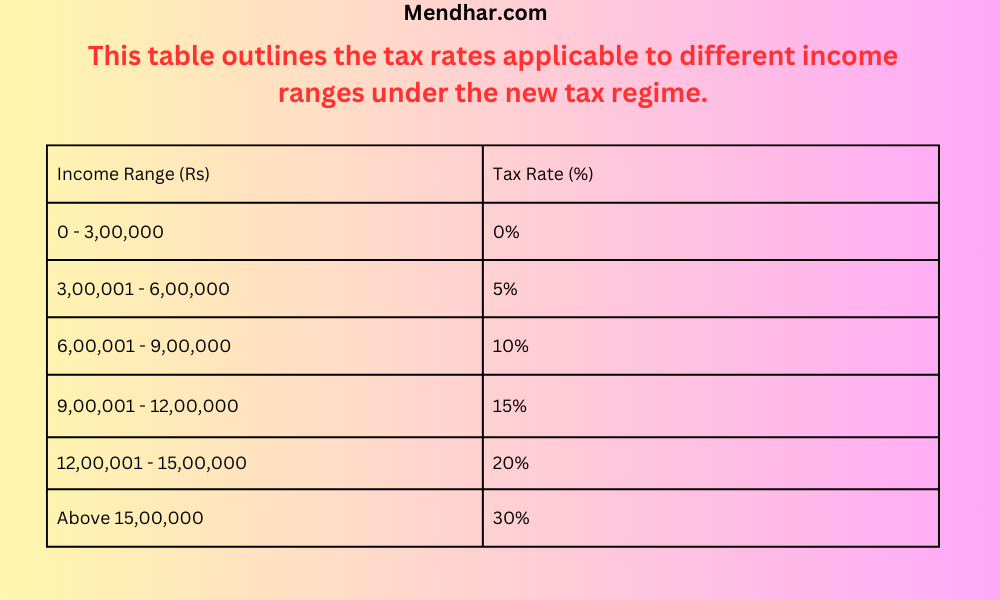

Now let's examine the details of the new income tax system:

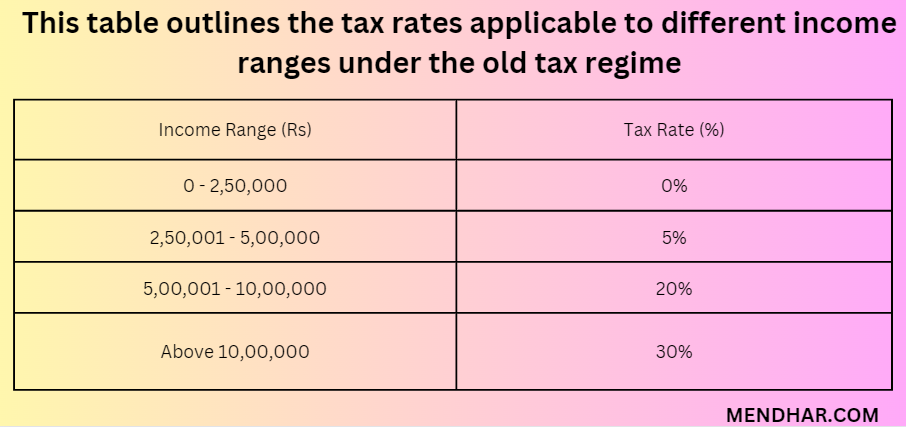

Let's compare Old tax regime with the New income tax regime:

It’s important to note that even if your salary exceeds Rs 7.5 lakh by just one rupee, you will be subject to income tax as per the new rates.

For instance, let’s consider an individual with an annual salary of Rs 7.60 lakh. The first Rs 7.50 lakh, including the standard deduction, is tax-free. However, the remaining Rs 10,000 is taxable. According to the new tax slab, the tax on this amount would be Rs 26,000. Nonetheless, the Income Tax Department has a rule where tax is levied only on the income exceeding Rs 7 lakh, or whichever amount is lesser.

In this scenario, the individual’s taxable income after the standard deduction would be Rs 7,10,000. Deducting the tax-free limit of Rs 3 lakh, we are left with Rs 4,10,000. Since there is no tax on the initial Rs 3 lakh, only Rs 1,10,000 is taxable. Based on the new tax rates, the tax on this amount would be Rs 11,000. Therefore, the individual would pay Rs 10,000 as income tax, as per the Income Tax Department’s rule.

Let’s investigate the computation in more detail now:

There are two tax slabs that apply to the Rs 4,10,000 taxable amount. At 5% tax, the first Rs 3,00,000 is taxed at Rs 15,000, or Rs 15.

The remaining 1,10,000 rupees is taxable at 10%. We get Rs 11,000 by deducting 10% from Rs 1,10,000.

The total income tax that results from adding these two amounts (Rs 15,000 + Rs 11,000) is Rs 26,000.

Nonetheless, the person will only have to pay Rs 10,000 in income tax because the taxable income only slightly above the income tax cap.

.

Frequently Asked Questions (FAQ)

1. What is the difference between the old and new tax regimes in India?

- The old tax regime in India follows a slab-based system where different income ranges are taxed at different rates, with various deductions and exemptions available. On the other hand, the new tax regime offers lower tax rates but fewer deductions and exemptions.

2. Can I switch between the old and new tax regimes?

- Yes, taxpayers have the flexibility to switch between the old and new tax regimes based on their preference and financial circumstances. However, once the choice is made for a particular financial year, it remains applicable for that year.

3. How do I choose between the old and new tax regimes?

- Taxpayers need to carefully evaluate their income, deductions, and exemptions to determine which regime is more beneficial for them. Factors such as investment portfolio, salary structure, and eligibility for deductions play a crucial role in this decision.

4. Are there any benefits to sticking with the old tax regime?

- The old tax regime offers a wider range of deductions and exemptions, including those for investments in certain financial instruments, house rent allowance (HRA), and medical insurance premiums. If you have significant investments and expenses that qualify for deductions, the old tax regime might be more advantageous.

5. What are the tax rates under the old tax regime?

- Under the old tax regime, the tax rates vary based on different income slabs. The rates are 0% for income up to Rs 2,50,000, 5% for income between Rs 2,50,001 and Rs 5,00,000, 20% for income between Rs 5,00,001 and Rs 10,00,000, and 30% for income above Rs 10,00,000.

Pingback: Nishtha 4.0 ECCE Diksha Course 6 Answer Key:Birth to 3 years-Early interventions for Special needs - Mendhar.com

New income system

Comprehensive Guide Table of Content: Quick glance at the latest Income Tax Slabs for FY 2023-24 What is the Income Tax Slab? Let’s better understand the Income Tax slabs under Union Budget 2023. Comparison of Tax Rates under New Tax Regime and Old Tax Regime for FY 2023-24 … Continue reading

Pingback: New Vs Old tax regime: Tax Benefit Comparison - Mendhar.com

Pingback: Income Tax Returns 2024: Old or New Tax Regime? Which has more benefit? - Mendhar.com

Pingback: Income Tax Return: Which Tax Regime I should choose for FY 2023-24? - Mendhar.com

Pingback: Income Tax dept. to act against J&K govt. employees for false refund claims -