Table of Contents

ToggleHow to Download Form 16 for ITR AY 2024-25 : A Step-by-Step Guide:

Tax season is upon us, and for many working individuals, it means tackling the daunting task of filing income tax returns. One essential document you’ll need is Form 16, which summarizes the income earned and taxes paid by an employee during the financial year. If you’re unsure how to obtain Form 16 for the Assessment Year (AY) 2024-25, worry not! This comprehensive guide will walk you through the process in simple steps.As the deadline for filing Income Tax Returns (ITR) for the Assessment Year (AY) 2024-25 approaches, it’s crucial to gather all necessary documents, including Form 16, which outlines your income and taxes paid during the financial year. If you’re uncertain about obtaining Form 16 for this period, fret not! This guide will lead you through the process in simple steps, ensuring you’re prepared for ITR filing before the deadline on July 31, 2025.

Lets understanding Form 16:

Before diving into the downloading process, let’s grasp what Form 16 entails. It’s a certificate issued by employers to their employees as proof of the Tax Deducted at Source (TDS) on their salary. Form 16 consists of two parts: Part A and Part B.

Part A: It contains details like the employer’s and employee’s PAN, TAN, summary of taxes deducted and deposited quarterly, and details of the employee and employer.

Part B: This section includes the detailed breakup of salary, allowances, deductions, and exemptions allowed under the Income Tax Act.

Requirements for Downloading Form 16:

To acquire Form 16 for the Assessment Year (AY) 2024-25, follow these steps:

1. Access to the Internet: Make sure you have a stable internet connection to navigate the required portals. You can use any device with internet connectivity, such as a computer, laptop, tablet, or smartphone.

2. Login Credentials: You’ll typically require login credentials provided either by your employer or the income tax department’s official website. If your employer provides Form 16 through an online portal, you’ll need to log in using the credentials provided by them. Alternatively, if you’re obtaining Form 16 directly from the income tax department’s website, you may need to create an account or use existing credentials to access the relevant section.

3. Correct Assessment Year: Ensure that you’re downloading Form 16 for the correct assessment year, which in this case is 2024-25. This distinction is crucial as it aligns with the financial year for which you are filing your taxes. Verify the assessment year before proceeding to download to avoid any discrepancies in your tax filing process.

By adhering to these steps and ensuring you have the necessary access and information, you’ll be well-equipped to download Form 16 for the AY 2024-25 efficiently and accurately, facilitating a smooth tax filing experience.

Step-by-Step Guide to Download Form 16:

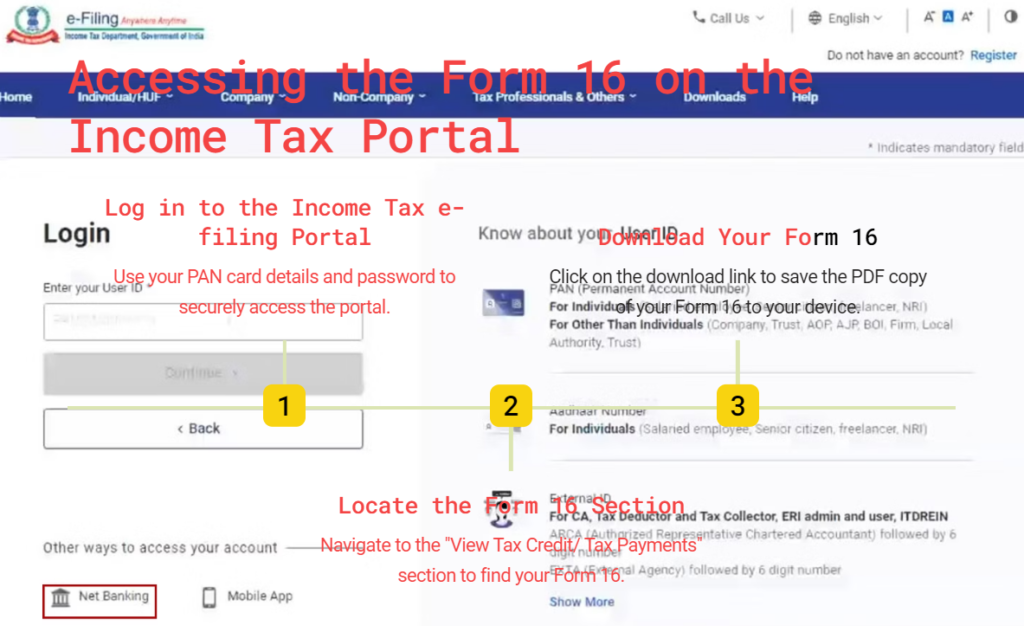

Step 1: Log in to the Income Tax Department’s Website:

Visit the official website of the Income Tax Department (https://www.incometaxindia.gov.in/) and navigate to the ‘Login’ section. Enter your PAN (Permanent Account Number) as the user ID and password.

Step 2: Go to the ‘e-Filing’ Portal:

Once logged in, you’ll be directed to the e-Filing portal. Look for the ‘e-File’ tab and select ‘Income Tax Returns’ from the drop-down menu.

Step 3: Choose the Relevant Assessment Year:

Since you’re downloading Form 16 for the AY 2024-25, ensure you select the correct assessment year from the options provided.

Step 4: Access Form 16:

After selecting the appropriate assessment year, navigate to the ‘View Form 16/16A’ option. Click on it to proceed.

Step 5: Verification and Download:

You may need to verify your credentials once again for security purposes. Once verified, you’ll be able to access and download Form 16 for the specified assessment year.

Alternative Methods:

If you encounter any issues with downloading Form 16 through the e-Filing portal, here are a couple of alternative methods:

Contact Your Employer: If you’re unable to access Form 16 online, reach out to your employer. They are obligated to provide you with a physical or digital copy of Form 16.

Request from the Income Tax Department: In certain cases, you can request a duplicate Form 16 directly from the Income Tax Department by submitting the necessary documents and following their prescribed procedure.

Key Points to Remember:download form16 :

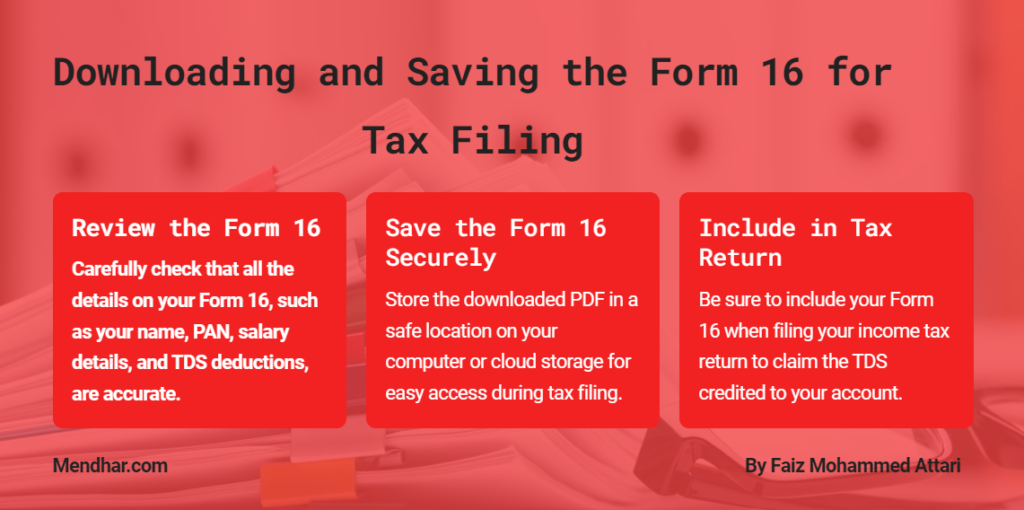

- Ensure all the details mentioned in Form 16 are accurate and match your financial records.

- Keep a digital and physical copy of Form 16 for your records and future reference.

- If you notice any discrepancies in Form 16, notify your employer or the income tax department promptly for rectification.

Downloading Form 16 for the AY 2024-25 is a crucial step in the income tax filing process. By following the steps outlined in this guide, you can easily obtain this document and proceed with filing your returns accurately and efficiently. Remember to keep all relevant documents handy and seek assistance from a tax professional if needed. Happy filing!

Pingback: Understanding Section 89 of Income Tax -