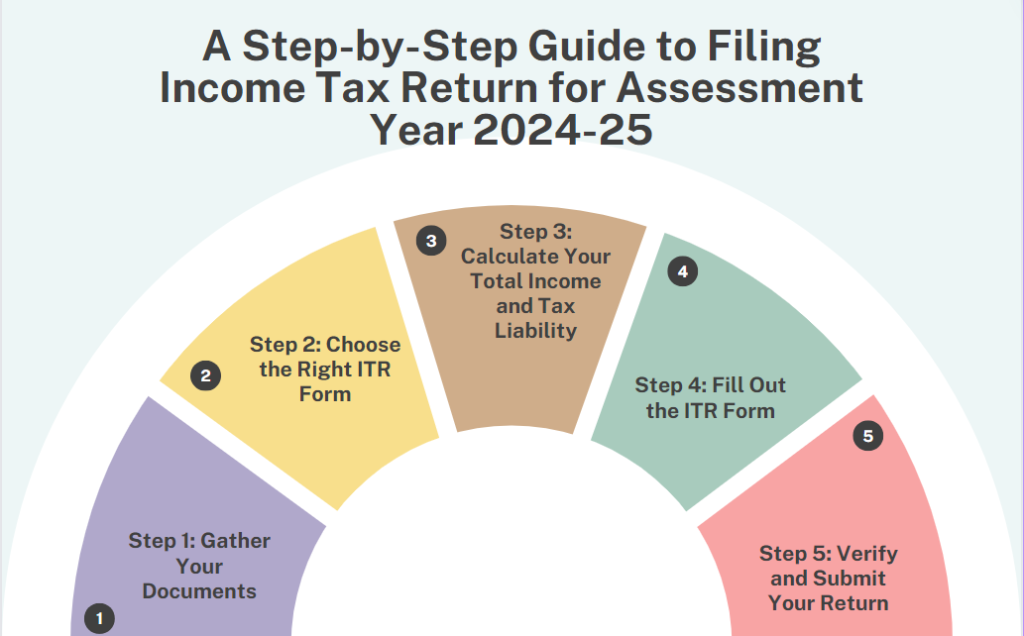

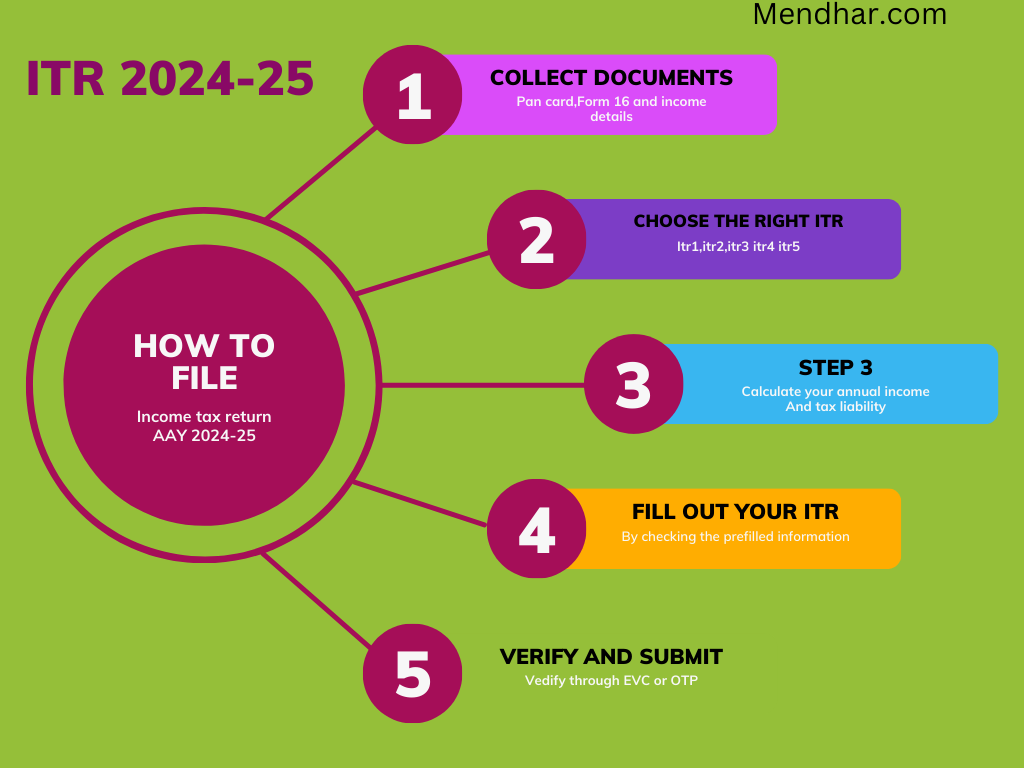

A Step-by-Step Guide to Filing Income Tax Return for Assessment Year 2024-25

Are you feeling overwhelmed by the thought of filing your Income Tax Return (ITR) for the Assessment Year 2024-25? Don’t worry; you’re not alone. Navigating the complexities of tax filing can be daunting, but with a clear guide and a little patience, you can breeze through the process. In this blog post, we’ll break down the steps to file your ITR in a simple and understandable way, complete with examples to help you along the way.

Step 1: Gather Your Documents:

Before diving into the filing process, gather all the necessary documents. This includes your PAN card, Aadhaar card, bank statements, Form 16 (if you’re a salaried individual), and any other relevant income documents like interest certificates from banks, rental income statements, or capital gains statements.

Example: Faiz, a salaried employee, gathers his Form 16 from his employer, bank statements showing interest income, and his PAN and Aadhaar cards.

Step 2: Choose the Right ITR Form

The next step is to choose the appropriate ITR form based on your income sources and eligibility. For AY 2024-25, the ITR forms may have been updated, so ensure you’re using the correct one. For example, if you’re a salaried individual with no other income sources, you’ll likely use ITR-1 (Sahaj). If you have income from multiple sources, you might need to use ITR-2 or ITR-3.

Example: Faiz, being a salaried individual with no other income sources, chooses to file his ITR using Form ITR-1.

Step 3: Calculate Your Total Income and Tax Liability

Once you have the right form, it’s time to calculate your total income and tax liability for the financial year. Include all sources of income such as salary, interest, rental income, capital gains, etc. Deduct eligible deductions under various sections like Section 80C, 80D, 80G, etc., to arrive at your taxable income.

Example: Faiz, calculates his total income from salary and interest earned on savings accounts. He then deducts his investments under Section 80C to arrive at his taxable income.

Step 4: Fill Out the ITR Form

Now, fill out the chosen ITR form accurately and completely. Provide all required details such as personal information, income details, deductions claimed, tax payments made, etc. Double-check the information to ensure accuracy and avoid any errors.

Example: Faiz fills out his ITR-1 form with his personal details, salary income, interest income, and deductions claimed under Section 80C.

Step 5: Verify and Submit Your Return

After filling out the form, it’s crucial to verify it either electronically or by sending a signed physical copy to the Centralized Processing Center (CPC) within 120 days of filing. Electronic verification can be done through Aadhaar OTP, net banking, or by generating an Electronic Verification Code (EVC).

Example: Faiz chooses to electronically verify his ITR using Aadhaar OTP.

Step 6: Keep Records for Future Reference

Once you’ve filed your ITR, keep copies of all relevant documents and the acknowledgment receipt for future reference. This will come in handy in case of any queries or audits by the Income Tax Department.

Example: Faiz saves a copy of his filed ITR along with all supporting documents in his digital tax folder.

Conclusion:

Filing your Income Tax Return doesn’t have to be intimidating. By following these simple steps and staying organized, you can complete the process efficiently and accurately. Remember to stay updated with any changes in tax laws and seek professional assistance if needed. Happy filing!

Frequently Asked Questions about Filing Income Tax Return for AY 2024-25

1. When is the deadline for filing Income Tax Return for AY 2024-25?

The deadline for filing Income Tax Return (ITR) for Assessment Year (AY) 2024-25 typically falls on July 31st of the assessment year. However, it’s advisable to keep an eye on any updates or extensions provided by the Income Tax Department.

2. Who needs to file Income Tax Return for AY 2024-25?

Individuals whose total income before deductions exceeds the basic exemption limit, individuals who wish to claim a refund, and those with certain specified financial transactions are required to file their Income Tax Return for AY 2024-25.

3. Which ITR form should I use for filing my return for AY 2024-25?

The choice of ITR form depends on your income sources, residential status, and other factors. For example:

- ITR-1 (Sahaj) for individuals having income from salaries, one house property, other sources (excluding winning from lottery and income from racehorses), and having total income up to Rs. 50 lakh.

- ITR-2 for individuals and HUFs not having income from profits and gains of business or profession.

4. Can I file my ITR after the deadline?

Yes, you can file your ITR after the deadline, but it would be considered a belated return. The deadline for filing belated returns is generally the end of the assessment year, i.e., March 31st, but it’s crucial to note that penalties and interest may apply.

5. What happens if I make a mistake in my filed return?

If you realize you’ve made a mistake in your filed return, you can rectify it by filing a revised return under Section 139(5) of the Income Tax Act. However, it’s important to do this within the specified time frame and ensure accurate details are provided in the revised return.

6. Do I need to submit any documents along with my ITR?

Typically, you don’t need to submit any documents along with your ITR. However, it’s advisable to keep all relevant documents such as Form 16, investment proofs, bank statements, and any other supporting documents handy in case they are required for verification or audit purposes.

7. Is it necessary to e-verify my filed return?

While it’s not mandatory, e-verifying your filed return is a convenient and secure way to complete the filing process. You can e-verify your return using methods such as Aadhaar OTP, net banking, or generating an Electronic Verification Code (EVC).