Table of Contents

ToggleFile Your Income Tax Return (ITR) Before the Deadline

As the Income Tax Return (ITR) filing season kicks off, taxpayers are reminded of the impending deadline of July 31st, heightening the urgency to file returns promptly. The e-filing portal, accessible since April, serves as a convenient avenue for taxpayers to fulfill their obligations efficiently. Filing on time not only ensures compliance with tax regulations but also helps avoid late fees and penalties. Taxpayers are encouraged to gather necessary documents, assess their financial transactions, and accurately report income to facilitate a smooth filing process. Seeking assistance from tax professionals or utilizing online resources can further streamline the process, ensuring timely submissiAon and peace of mind.

Why Should You File Your ITR on Time?

Absolutely! Filing your Income Tax Return (ITR) on time not only fulfills your legal obligation but also offers several advantages:

1. Avoid Late Fees: Missing the deadline can lead to penalties, which can be significant, especially based on your income level. Filing on time helps you steer clear of these unnecessary expenses.

2. Faster Processing: Early filers typically enjoy quicker processing of their returns. This can translate to faster refunds, if you’re eligible for one. Getting your refund sooner can be particularly helpful for managing finances or investing.

3. Compliance and Peace of Mind: Timely filing ensures that you’re in compliance with tax laws. It provides peace of mind, knowing that your taxes are accurately reported and settled. This can alleviate the stress associated with potential audits or penalties for late filing.

By filing your ITR promptly, you not only fulfill your civic duty but also optimize your financial situation, ensuring smooth processing and compliance with tax regulations.

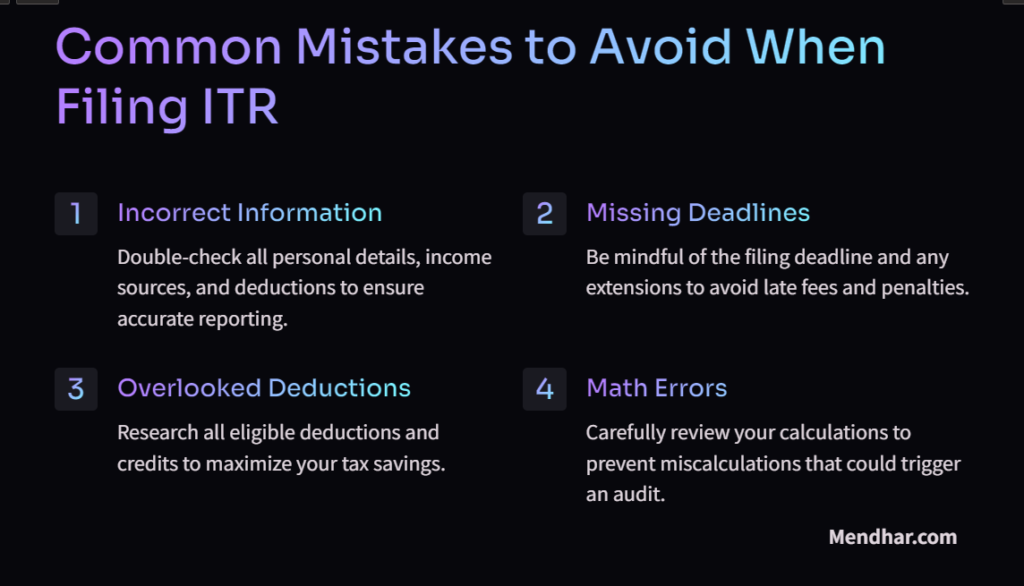

Things to Note Before Filing Your ITR:

Before embarking on the e-filing journey, consider these essential points:

1. Gather Documents: Collect all necessary paperwork such as Form 16 (for those employed), bank statements, investment proofs, and any other relevant documents. Having these ready streamlines the filing process.

2. Select the Correct ITR Form: Ensure you choose the appropriate ITR form based on your income sources and financial circumstances. For many salaried individuals, ITR-1 (Sahaj) suffices. However, if you have income from multiple sources or specific situations, another form might be necessary.

3. Review Pre-filled Information: The e-filing portal often populates certain details based on your PAN information. Take a moment to verify this data for accuracy and completeness. Any discrepancies should be corrected before submission.

4. Claim Deductions and Exemptions: Maximize your tax benefits by claiming all eligible deductions and exemptions. This includes deductions under Section 80C, 80D, HRA, and others. Utilizing these provisions helps minimize your tax liability effectively.

5. Verify Bank Account Details: Ensure that you provide accurate bank account information for any potential tax refunds. Verifying these details prevents delays or issues in receiving refunds, ensuring a smooth financial process.

Keeping these pointers in mind before diving into e-filing can streamline the process, minimize errors, and optimize your tax-saving opportunities.

Demo: How to File ITR-1 (Sahaj):

Sure, here’s a detailed breakdown of the step-by-step process for filing your ITR-1 using the e-filing portal:

1. Login: Begin by visiting the Income Tax e-filing portal and logging in using your credentials. If you’re a new user, you’ll need to register and create an account first.

2. Select ITR-1: Once logged in, navigate to the option for filing income tax returns and select the ITR-1 form from the available options. Ensure that you choose the correct form based on your income sources and eligibility.

3. Pre-filled Information: The e-filing portal will pre-fill certain information such as personal details, income details from Form 16 (if available), and tax payments made during the year. Take the time to carefully verify this pre-filled information for accuracy and completeness.

4. Fill in Additional Details: Provide details of any additional income sources, deductions, exemptions, or tax payments that are not pre-filled by the portal. This may include income from interest, rental income, capital gains, or any other sources.

5. Compute Tax Liability: The e-filing portal automatically computes your tax liability based on the information provided. It calculates the total taxable income, applies the applicable tax rates, and determines the final tax amount owed or refundable.

6. Verify and Submit: Before submitting your return, thoroughly review all the details entered to ensure accuracy. Check for any errors or discrepancies and make corrections as needed. Once you’re confident that all information is accurate, proceed to submit your return electronically.

7. E-Verify: After successfully submitting your return, it’s essential to e-verify it to complete the filing process. You can e-verify your return using various methods such as Aadhaar OTP, net banking, electronic verification code (EVC), or sending a signed physical copy to the Income Tax Department.

By following these steps systematically, you can file your ITR-1 smoothly and accurately using the e-filing portal, ensuring compliance with tax regulations and minimizing the risk of errors or delays.

FAQ related to filing Income Tax Returns (ITR):

Who needs to file an Income Tax Return (ITR)?

- Generally, any individual whose total income exceeds the minimum threshold as per the Income Tax Act is required to file an ITR. However, specific exemptions and provisions may apply based on age, income sources, and other factors.

What is the deadline for filing Income Tax Returns (ITR)?

- The deadline for filing ITR in India is typically July 31st of the assessment year, for most individuals. However, it’s essential to check for any updates or extensions provided by the Income Tax Department.

What are the consequences of not filing Income Tax Returns (ITR) on time?

- Failure to file ITR on time can result in penalties and late fees. Additionally, it may lead to difficulties in obtaining loans, visas, or other financial transactions where proof of tax compliance is required.

How can I file my Income Tax Return (ITR)?

- Income Tax Returns can be filed online through the Income Tax e-filing portal or manually by submitting a physical copy to the designated tax office.

Which ITR form should I use for filing my return?

- The appropriate ITR form depends on various factors such as income sources, residential status, and financial situation. Individuals should carefully select the correct form to ensure accurate filing.