Table of Contents

ToggleUnderstanding Prima Facie Adjustment Return (PFA): Responding to Notice u/s 143(1)(a) and Awaiting Refund

Tax season often brings a mix of stress and anticipation, with taxpayers navigating numerous forms, compliance requirements, and deadlines. For many individuals, the prospect of receiving a tax refund is a welcome relief amidst the complexity. However, there are instances when the tax authorities issue notices, such as Notice u/s 143(1)(a), which necessitate prompt and careful attention. This blog aims to elucidate the intricacies of responding to Notice u/s 143(1)(a), understanding the Prima Facie Adjustment Return (PFA), and managing expectations when awaiting a refund.

What is Notice u/s 143(1)(a)?

Notice u/s 143(1)(a) is a formal communication from the Income Tax Department that indicates a discrepancy or adjustment in the tax return you filed. This notice is issued under Section 143(1) of the Income Tax Act, 1961, and typically arises when there are inconsistencies between the income reported in your return and the data available with the tax authorities. The primary purpose of Notice u/s 143(1)(a) is to inform the taxpayer about any proposed adjustments or discrepancies, seeking their response to resolve the issue.

When a taxpayer receives Notice u/s 143(1)(a), it often pertains to adjustments that the tax authorities have made based on their records. These adjustments may involve mathematical errors, incorrect claims of deductions, discrepancies in income details, or mismatches with information available in Form 26AS or other sources. For example, if a taxpayer claims a deduction that doesn’t comply with the tax laws or if there are arithmetic errors in the return, the tax department will propose prima facie adjustments and notify the taxpayer accordingly. Understanding the nature of these adjustments is crucial to responding appropriately and avoiding future tax complications.

Prima Facie Adjustment Return (PFA):

The concept of Prima Facie Adjustment Return (PFA) is central to the notice issued u/s 143(1)(a). Prima Facie Adjustment refers to preliminary adjustments made by the tax authorities before finalizing a tax return. These adjustments are based on the information available with the tax department and the return filed by the taxpayer. The objective is to rectify apparent errors or discrepancies at an early stage to ensure accuracy and compliance.

For instance, if you have claimed a deduction that seems ineligible or there is an arithmetical inaccuracy, the tax department will make prima facie adjustments and communicate these through a notice. It’s imperative to comprehend these adjustments thoroughly, as they form the basis for the discrepancies highlighted in the notice. Responding accurately and substantiating your claims with appropriate documentation can prevent further complications and ensure your return is processed smoothly.

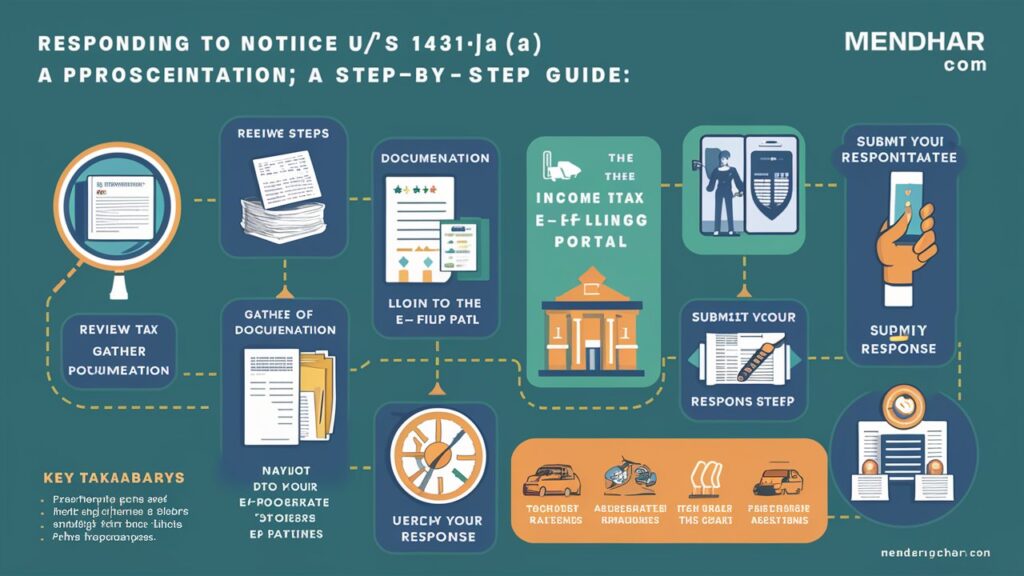

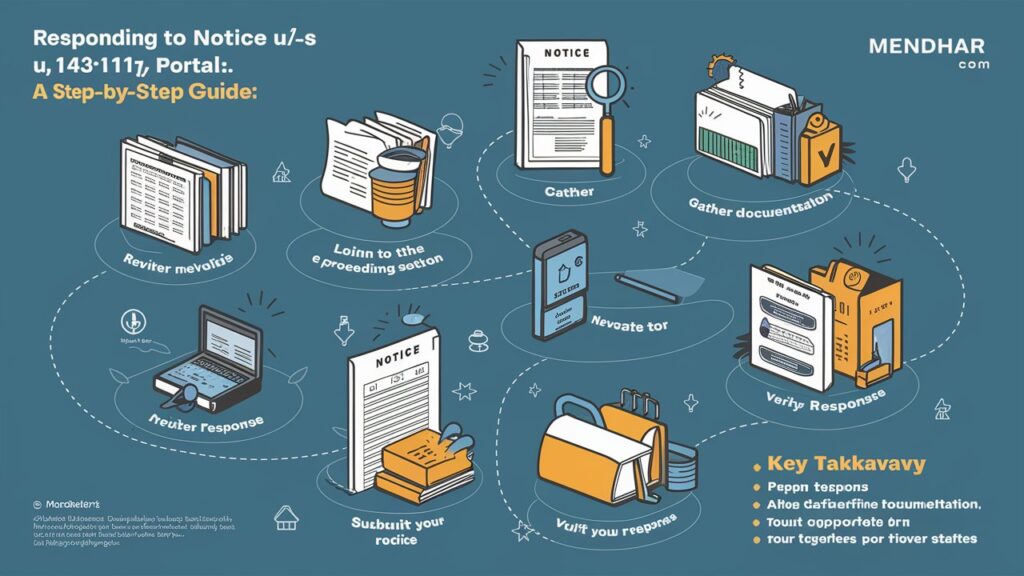

Steps to Respond to Notice u/s 143(1)(a):

Responding to Notice u/s 143(1)(a) requires a systematic approach to ensure that the discrepancies are resolved effectively. Here are the detailed steps to follow:

Review the Notice: The first step is to meticulously review the notice. Understand the discrepancies or adjustments mentioned. The notice will typically specify the nature of the discrepancy and the proposed adjustment, providing a clear indication of what needs to be addressed.

Gather Documentation: Collect all relevant documents that support your tax return. This may include Form 16, investment proofs, receipts, and any other documentation that can validate your claims. Proper documentation is essential to substantiate your response and clarify any discrepancies.

Login to the Income Tax e-Filing Portal: To respond to the notice, log in to your account on the Income Tax e-Filing portal using your PAN number and password. The e-Filing portal provides a user-friendly interface to manage and respond to such notices.

Navigate to the e-Proceedings Section: Once logged in, go to the ‘e-Proceedings’ section where you will find the notice. Click on the notice number to view the details. This section allows you to view and respond to notices efficiently.

Submit Your Response: You have the option to either agree or disagree with the proposed adjustments. If you agree with the adjustments, you can accept them, and the revised return will be processed accordingly. If you disagree, provide a detailed explanation along with supporting documents to justify your claims. Ensure that your response is comprehensive and addresses all the points raised in the notice.

Verify Your Response: After submitting your response, ensure that it is verified. This verification can be done through various methods like Aadhaar OTP, net banking, or by sending a signed copy of the acknowledgment to the Centralized Processing Center (CPC). Verification is a crucial step to complete the process and ensure that your response is officially recorded.

Awaiting Refund: What to Expect?

After filing your return and addressing any notices such as Notice u/s 143(1)(a), the next phase involves waiting for the refund. Here’s what you need to know about the refund process and how to manage your expectations:

Return Processing: Once your return is filed and verified, the Income Tax Department begins processing it. This involves checking the accuracy of the details provided, calculating the tax liability, and verifying the TDS credits. The processing time can vary, but the department aims to complete it as efficiently as possible.

Notice and Adjustments: If any discrepancies are found during processing, you may receive a Notice u/s 143(1)(a). As discussed, it’s essential to respond promptly to avoid delays in refund processing. Timely resolution of any issues is crucial to ensure that your refund is not held up.

Refund Calculation: After resolving any issues, the department calculates the refund amount due to you. The status of your refund can be tracked on the e-Filing portal. Regular tracking helps you stay informed about the progress and any additional actions required.

Refund Issuance: Once processed, the refund is credited to your bank account. Ensure that the bank account details provided in your return are accurate and up-to-date. Any errors in bank details can delay the refund process, so it’s important to verify these details carefully.

Key Takeaways:

Prompt Response: Always respond promptly to Notice u/s 143(1)(a) to avoid penalties and delays in refund processing. Prompt action demonstrates compliance and helps expedite the resolution process.

Accurate Documentation: Maintain accurate records and documentation to support your tax return claims. Proper documentation is essential to substantiate your claims and respond effectively to any notices.

Track Refund Status: Regularly check the status of your refund on the Income Tax e-Filing portal to stay updated. Keeping track of the status helps you stay informed and take timely action if needed.

Conclusion:

Navigating through tax notices like Notice u/s 143(1)(a) and understanding the Prima Facie Adjustment Return (PFA) is crucial for a smooth tax filing experience. By promptly responding to notices, maintaining accurate documentation, and understanding the refund process, taxpayers can ensure a hassle-free experience and avoid unnecessary complications.

If you find yourself dealing with a Notice u/s 143(1)(a), remember to stay calm, gather your documents, and respond accurately and promptly. Addressing the notice effectively can prevent further issues and ensure that your tax return is processed smoothly. And while awaiting your refund, ensure that your bank details are correct and keep track of the processing status.

Being proactive and informed in your tax dealings helps manage your taxes efficiently and makes the most of your refunds. Understanding the process and taking timely action can significantly reduce stress and enhance your tax filing experience.

Shamim Akhter Master HS Pathanateer zone Mendhar