Table of Contents

ToggleLatest GST Rates and Benefits: Everything You Need to Know in 2025

The Goods and Services Tax (GST) has been one of the most transformative reforms in India's taxation history. Introduced to unify multiple indirect taxes into a single system, GST has simplified compliance, boosted transparency, and promoted a nationwide market. In September 2025, the government implemented a major restructuring known as GST 2.0, which revised the tax slabs, making them simpler and more consumer-friendly. In this blog, we'll break down the Latest GST Rates and Benefits, explain what has changed, and highlight how it impacts businesses, consumers, and the economy at large.

What Are the Latest GST Rates in India?

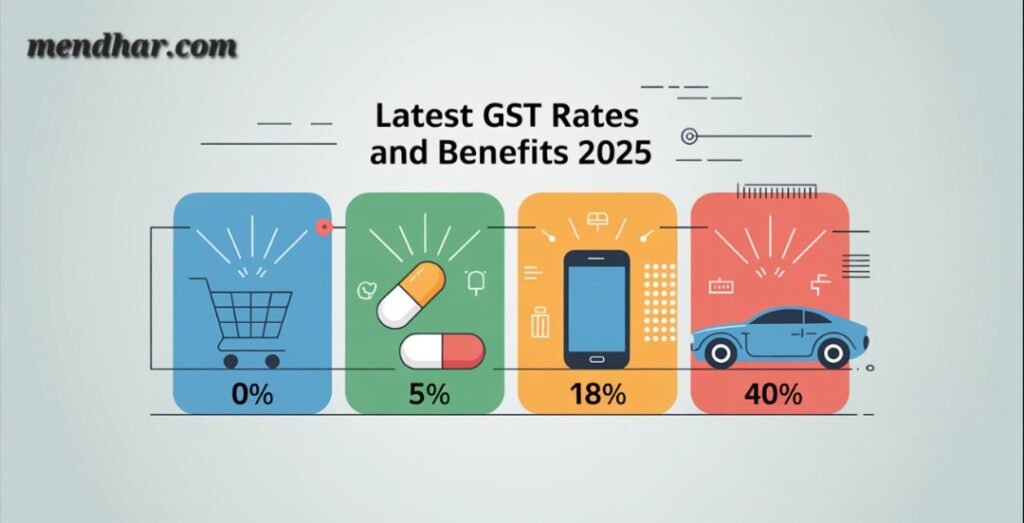

The Latest GST Rates and Benefits were announced in September 2025 after the 53rd GST Council meeting. The aim was to simplify the structure, reduce the burden on essential items, and create a fair balance for both common households and luxury consumption. Earlier, GST had six major slabs (0%, 5%, 12%, 18%, and 28% with a few special rates like 3% and 0.25%). The new regime has streamlined these into four main slabs:

1. 0% (Nil / Exempt Rate)

- Covers essential goods and services.

- Basic food items, healthcare services, and some everyday needs fall into this category.

- Designed to keep necessities tax-free, supporting affordability for lower-income groups.

2. 5% (Reduced Rate)

- Applied on common goods like medicines, packaged food products, and low-cost consumer goods.

- Many items that previously attracted higher taxes were shifted here, offering relief to households.

3. 18% (Standard Rate)

- The most widely used slab, covering a broad range of goods and services.

- Earlier, products in the 12% and 28% categories were mostly merged into 18%.

- Includes electronics, mobile phones, general services, and manufactured goods.

4. 40% (Luxury / Sin Goods)

- Reserved for high-end luxury items, expensive cars, tobacco products, and "sin goods."

- The intention is to tax the rich more heavily while easing the burden on essential commodities.

Overall, more than 375 items saw a reduction in tax rates, ranging from food products to consumer electronics and even construction materials like cement. This restructuring is expected to directly benefit millions of households by reducing prices and stimulating demand.

Key Benefits of GST in 2025

The Latest GST Rates and Benefits aren't just about numbers; they create real impact for businesses, consumers, and the government. Let's break down the advantages:

1. Benefits for Consumers

- Lower Tax Burden: With essentials moved to the 0% and 5% slabs, everyday shopping costs less.

- Transparent Pricing: GST makes the tax component clearly visible, avoiding hidden or overlapping taxes.

- Fair Pricing: Anti-profiteering laws ensure that when GST rates are cut, businesses must pass the benefit to consumers.

2. Benefits for Businesses

- Elimination of Cascading Taxes: Under the old system, businesses faced "tax on tax." Now, input tax credit ensures a smooth chain of taxation.

- Uniform Market Across India: No state-level VAT or service tax differences mean easier interstate trade.

- Digital Compliance: Registrations, returns, and refunds are processed online, cutting down paperwork and corruption.

- Support for Small Businesses: The composition scheme allows small traders to pay simplified rates with fewer compliance requirements.

3. Benefits for the Government

- Higher Tax Compliance: With an IT-driven system, tax evasion is harder. More businesses are now part of the formal economy.

- Steady Revenue Collection: GST brings consistency and predictability to government revenues.

- Boost to "Make in India": Lower input costs and better supply chains help attract investment and promote domestic manufacturing.

4. Benefits for the Economy

- Efficient Supply Chains: Smooth inter-state movement of goods reduces logistics costs.

- Level Playing Field: Uniform tax rules prevent arbitrage between states.

- Growth Driver: Lower taxes on essentials increase purchasing power, which drives demand and overall economic growth.

Before vs After: Why GST 2.0 Matters

To truly understand the Latest GST Rates and Benefits, it's important to compare the old system with the new one.

Old System (Pre-September 2025):

- Six slabs created confusion (0%, 5%, 12%, 18%, 28% + special rates).

- Many household goods were stuck in 12% and 28% categories, making them unnecessarily expensive.

- Interstate trade faced hurdles due to varying interpretations.

New System (Post-September 2025):

- Streamlined into four clear slabs: 0%, 5%, 18%, and 40%.

- Essentials are cheaper, luxuries taxed higher.

- Easier compliance for businesses and better transparency for consumers.

This structural simplification is expected to save households money, reduce compliance costs for small businesses, and help the government focus on high-value tax collection.

Real-World Impact of Latest GST Rates and Benefits

Imagine a middle-class family buying groceries, medicines, and an electronic appliance:

For businesses, a trader who buys goods at 18% GST can now offset that tax against his sales liability, ensuring no cascading effect. For the government, every transaction is digitally recorded, improving tax collection efficiency.

Challenges That Remain

While the Latest GST Rates and Benefits are significant, some challenges continue:

Compliance Burden for Small Traders

Even with digital systems, small businesses often struggle with filings.

Awareness Issues

Many people, especially in rural areas, are still unaware of GST reforms.

Tax Disputes

Although reduced, disputes over classification of goods into different slabs still exist.

Addressing these challenges will ensure that GST fully achieves its goals of inclusivity and economic growth.

Conclusion

The Latest GST Rates and Benefits in 2025 represent a major leap forward in India's taxation system. By simplifying slabs, reducing the burden on essential goods, and taxing luxuries at higher rates, GST 2.0 balances affordability with fairness. Consumers gain through lower costs, businesses enjoy simplified compliance, and the government benefits from improved revenue and efficiency.

In short, the GST reform is not just a tax change but an economic strategy that drives growth, supports "Make in India," and creates a unified national market. As households save more and businesses expand, the Latest GST Rates and Benefits are set to shape India's economic future positively.