Table of Contents

ToggleThe Reality of UPS: A Closer Look

The Ministry of Finance recently announced the Unified Pension Scheme (UPS) for central government employees. It offers an alternative to the National Pension System (NPS) by providing an assured pension and a lump sum payment upon retirement. The Reality of UPS is that it is designed to enhance financial security for government employees who opt for it.

What is UPS?

The Unified Pension Scheme (UPS) is a voluntary pension scheme for central government employees currently enrolled under NPS. Employees opting for UPS will receive a guaranteed pension and a lump sum amount upon retirement. The scheme applies to employees who:

Retire at the age of 60 years.

Take voluntary retirement after completing 25 years of service.

The Reality of UPS is that it ensures financial stability for retirees through government-backed benefits.

Key Features of UPS

Assured Pension: Unlike NPS, where pension depends on market-linked returns, UPS guarantees a fixed pension amount.

Lump Sum Payment: Employees receive an additional payout upon retirement, calculated based on years of service and last drawn emoluments.

Eligibility: Employees must have at least 10 years of qualifying service to be eligible for the lump sum payment.

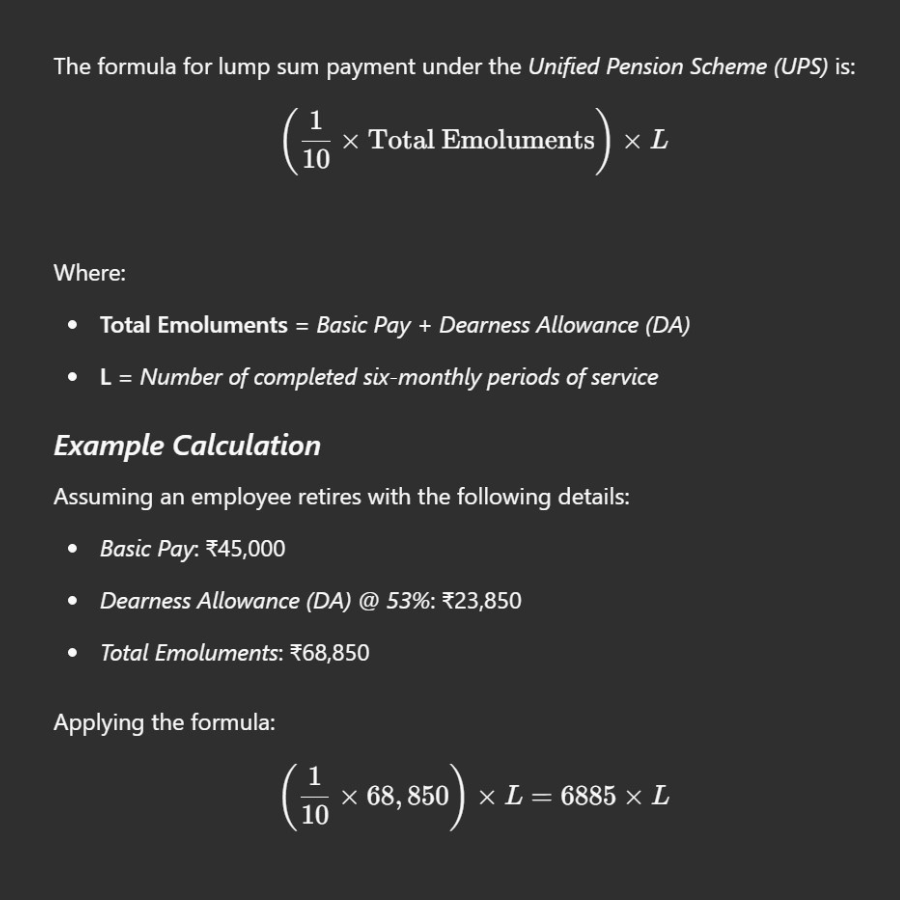

Lump Sum Calculation Formula in UPS

Lump Sum Payment Table under UPS

| 1/10 of Emoluments (₹) | Length of Service (Months) | Completed 6-Month Periods (L) | Lump Sum Amount (₹) |

|---|---|---|---|

| 6,885 | 10 years (120 months) | 20 | 1,37,700 |

| 6,885 | 15 years (180 months) | 30 | 2,06,550 |

| 6,885 | 20 years (240 months) | 40 | 2,75,400 |

| 6,885 | 25 years (300 months) | 50 | 3,44,250 |

| 6,885 | 30 years (360 months) | 60 | 4,13,100 |

| 6,885 | 35 years (420 months) | 70 | 4,81,950 |

Important Points to Note

The lump sum payment does not reduce the assured pension under UPS.

Employees with less than 10 years of service are not eligible for the lump sum payment.

The Reality of UPS is that it ensures pension security without reducing post-retirement payouts.

How UPS Compares to NPS

| Feature | Unified Pension Scheme (UPS) | National Pension System (NPS) |

| Assured Pension | Yes | No, depends on market returns |

| Lump Sum Payment | Yes | No, only retirement corpus is available |

| Minimum Service Required | 10 years | No minimum, but the pension is market-dependent |

| Control Over Pension Funds | Government-managed | Partially controlled by private fund managers |

| Withdrawal Flexibility | Limited | More flexible but market-linked |

Is UPS Beneficial for Employees?

The Unified Pension Scheme (UPS) provides financial stability to government employees. Here are some pros and cons of choosing UPS over NPS:

Advantages of UPS

✔ Guaranteed Pension: No dependency on market fluctuations.

✔ Lump Sum Benefit: Additional financial support upon retirement.

✔ Better Financial Security: Assured benefits improve post-retirement planning.

Disadvantages of UPS

✘ Less Flexibility: Employees have fewer investment choices compared to NPS.

✘ Government-Controlled: Pension funds are managed entirely by the government.

✘ Not Available for Private Sector: Only central government employees can opt for UPS.

The Reality of UPS is that while it provides financial security, it also limits investment flexibility.

The Unified Pension Scheme (UPS) offers financial stability to government employees by ensuring a guaranteed pension, lump sum benefits, and better financial security. However, it lacks flexibility, is entirely government-controlled, and is not available for private-sector employees.

Overall, the Old Pension Scheme (OPS) remains a more beneficial option as it provides lifetime financial security without market risks, making it a preferred choice for government employees.

Frequently Asked Questions (FAQ)

1. Who can opt for the Unified Pension Scheme (UPS)?

Only central government employees currently under NPS can opt for UPS.

2. Is UPS mandatory for government employees?

No, UPS is voluntary. Employees can choose to remain in NPS if they prefer market-linked returns.

3. Can employees switch back to NPS after opting for UPS?

No, once an employee opts for UPS, switching back to NPS is not allowed.

4. How is the lump sum payment calculated under UPS?

The lump sum payment is calculated as:

where L is the number of completed six-monthly service periods.

5. What happens if an employee retires before 10 years of service?

Employees with less than 10 years of service are not eligible for the lump sum payment.

6. Does opting for UPS affect the assured pension amount?

No, the lump sum payment does not impact the assured pension under UPS.

Conclusion

The reality of the Unified Pension Scheme (UPS) is that it ensures financial security for government employees while maintaining a structured pension plan. Employees who prioritize stability over flexibility may find UPS more suitable, whereas those seeking investment opportunities might prefer the National Pension System (NPS).

However, the Old Pension Scheme (OPS) remains the most beneficial option, as it guarantees lifelong financial security without market risks or criticisms. The government should consider restoring OPS, as it provides the best financial stability for retirees.

Would you opt for UPS over NPS? Let us know your thoughts in the comments!