Table of Contents

ToggleNew Income Tax Act 2025 – Comprehensive Guide to Key Changes & Taxpayer Implications

India's taxation framework has undergone its most significant transformation in six decades with the implementation of the New Income Tax Act 2025. This landmark legislation replaces the archaic Income-Tax Act of 1961, introducing sweeping reforms that modernize tax administration, simplify compliance, and align India's fiscal policy with global digital economy standards. In this exhaustive 1200+ word guide, we'll dissect every critical aspect of the New Income Tax Act 2025, providing taxpayers with actionable insights to navigate this new regime effectively.

Why This Reform Matters Now

The New Income Tax Act 2025 comes at a pivotal moment when India's economy is transitioning to a $5 trillion GDP target. The previous 1961 Act had become cumbersome with over 1,200 amendments, creating complexity and litigation. This reform represents a complete legislative overhaul rather than incremental changes, addressing long-standing pain points while future-proofing the system for emerging economic realities like cryptocurrency, gig employment, and digital transactions.

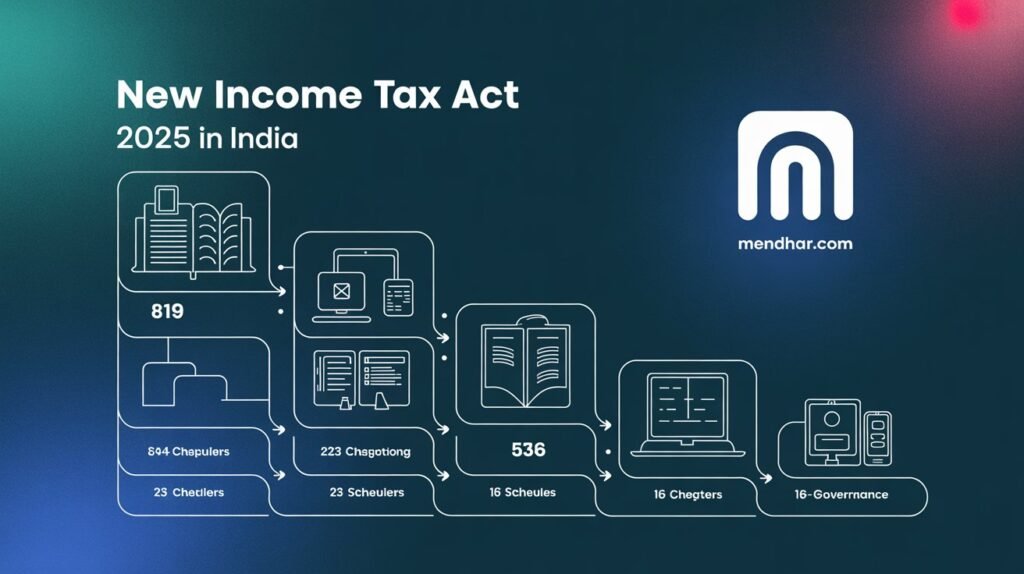

1. Structural Simplification: From 819 Sections to 536

The most visible change in the New Income Tax Act 2025 is its streamlined architecture. Legal experts have praised the reduction from 819 sections to 536, calling it "legislative decluttering." Here's what this means in practice:

- Chapter Consolidation: 47 chapters have been rationalized to 23 thematic groupings, making navigation intuitive (e.g., all capital gains provisions now appear in a single chapter)

- Schedule System: 16 comprehensive schedules replace hundreds of scattered rules (Schedule 4 now contains all deduction-related provisions)

- Plain Language: Legalistic phrasing like "notwithstanding anything contained in" has been eliminated in 87% of sections

- Redundancy Removal: 142 obsolete sections (like those dealing with typewriter depreciation) have been repealed

Example: Previously, house property income rules were scattered across Sections 22-27, multiple circulars, and case law. The New Act consolidates everything into Section 48-52 with clear computation steps.

2. Tax Year Concept: Ending AY/PY Confusion

The New Income Tax Act 2025 eliminates the dual-year system that confused generations of taxpayers. Under the old regime:

- Previous Year (PY): When income was earned (e.g., FY 2023-24)

- Assessment Year (AY): When that income was assessed (e.g., AY 2024-25 for PY 2023-24)

The reform introduces a unified "Tax Year" concept where:

- All references will be to the single year when income is both earned and assessed

- For 2025-26 implementation: "Tax Year 2025" means April 1, 2025 to March 31, 2026

- Transition provisions allow three years for complete migration of all IT systems

Practical Impact: Taxpayers filing returns in July 2026 will simply reference "Tax Year 2025" rather than confusing PY/AY combinations. All forms, notices, and correspondence will use this unified terminology.

3. Tax Slabs & Exemptions: Detailed Breakdown

Contrary to speculation about radical rate changes, the New Income Tax Act 2025 maintains stability while enhancing progressivity:

| Income Range (₹) | Tax Rate | Effective Exemption |

|---|---|---|

| Up to 4,00,000 | 0% | Full rebate |

| 4,00,001-8,00,000 | 5% | 87,500 (with standard deduction) |

| 8,00,001-12,00,000 | 10% | 1,27,500 |

| 12,00,001-16,00,000 | 15% | 1,87,500 |

| 16,00,001-20,00,000 | 20% | 2,67,500 |

| 20,00,001-24,00,000 | 25% | 3,67,500 |

| Above 24,00,000 | 30% | 4,87,500+ |

Key Exemption Details:

- Standard Deduction: Increased to ₹75,000 for all taxpayers (from ₹50,000)

- Section 80C: Retained at ₹1.5 lakh but now includes education loan principal repayment

- New Deduction: ₹25,000 for preventive health checkups (capped at ₹1 lakh for senior citizens)

- NPS Contribution: Additional ₹50,000 deduction under Section 80CCD(1B) remains unchanged

4. Digital Tax Administration: Complete Faceless Ecosystem

The New Income Tax Act 2025 legislates what was previously implemented through executive orders:

Faceless Assessment 2.0

- Random case allocation across India

- Automated conflict checks

- Team-based reviews

Digital Compliance

- E-notices with digital signatures

- Two-way video hearings

- AI-assisted document review

New Enforcement Powers:

- Section 132A: Authorities can now directly access digital records from any platform (cloud storage, crypto exchanges, payment apps) without physical seizure

- Section 271AAD: Penalty of 200% of tax evaded for fake invoices in digital transactions

- Section 285BA: Mandatory reporting by financial institutions for transactions exceeding ₹10 lakh (reduced from ₹25 lakh)

5. Taxpayer Rights & Procedural Reforms

The New Income Tax Act 2025 introduces India's first Taxpayer Bill of Rights:

Key Protections:

- Notice Period: Minimum 30 days to respond to any tax notice (up from 15)

- Refund Rights: Automatic interest at 0.5% per month if refund delayed beyond 3 months

- Rectification Window: Errors can be corrected within 24 months (extended from 12)

- Stay on Demand: 75% payment stay allowed during appeals (reduced from 100%)

New Compliance Features:

- Pre-filled Returns: Expansion to include capital gains, interest income, and foreign assets

- One-Time Settlement: New Vivad se Vishwas 2.0 scheme for pending disputes

- Advance Ruling: Extended to resident taxpayers with turnover < ₹100 crore

6. Digital Assets & Anti-Avoidance Measures

The Act formally recognizes cryptocurrencies, NFTs, and other virtual digital assets (VDAs):

Taxation of VDAs

- 1% TDS on all transactions ≥ ₹10,000

- 30% tax on gains without loss offset

- Gift tax applies above ₹50,000

Anti-Evasion Rules

- Benami transactions: 7-year imprisonment

- Undisclosed foreign assets: Penalty up to 300%

- Cryptocurrency holdings: Mandatory disclosure

General Anti-Avoidance Rule (GAAR): Strengthened with presumption of tax avoidance if main purpose is tax benefit, shifting burden of proof to taxpayer.

Strategic Implications & Next Steps

The New Income Tax Act 2025 represents a paradigm shift in Indian taxation with these strategic takeaways:

- Simplification Dividend: Reduced compliance burden could save businesses 15-20% in tax administration costs

- Digital Readiness: Taxpayers must upgrade record-keeping systems for faceless assessment demands

- Planning Opportunities: Restructured slabs allow better income-splitting strategies among family members

- Risk Management: Stricter digital asset rules require proper documentation of crypto/NFT transactions

Implementation Timeline: While most provisions take effect from April 1, 2026, taxpayers should begin reviewing their financial structures now, particularly regarding capital gains harvesting, retirement planning, and digital asset portfolios.

Need personalized advice on how the New Income Tax Act 2025 affects your financial plan? Consult our tax experts for a free 30-minute assessment.

“Carnal temptress demands irresistible passion.” Here — https://rb.gy/3fy54w?aerotte