Table of Contents

ToggleIncome Tax Slab AY 2026-27 (FY 2025-26): Complete Guide with Examples, Rebates & Section 87A Explained

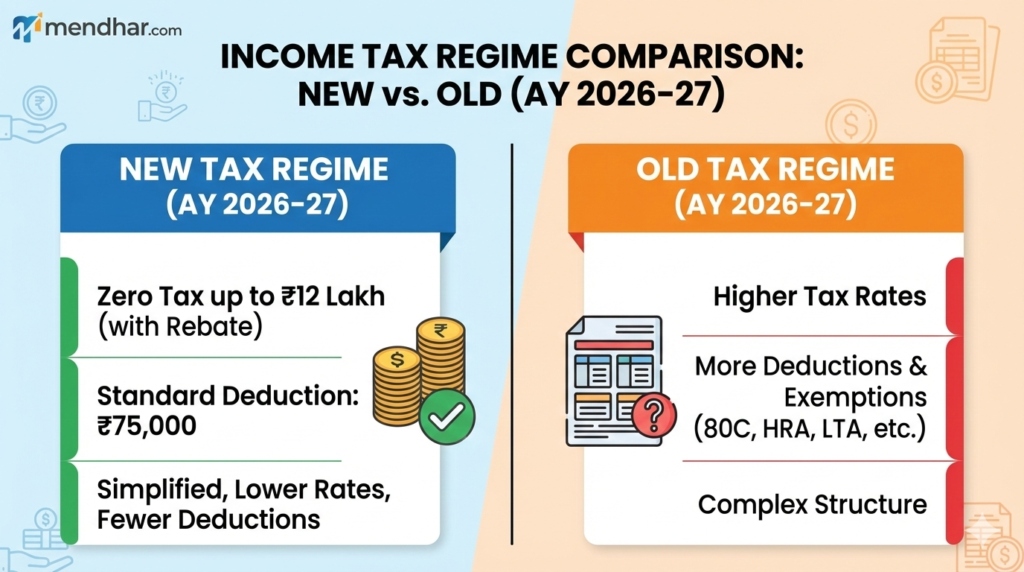

Indian taxpayers eagerly awaited the Income Tax rates for Assessment Year (AY) 2026-27, and the Union Budget 2025 (effective from 1 April 2025) delivered a simplified structure that’s taxpayer-friendly — especially for middle-income earners. The tax slabs under the New Tax Regime were revised to widen the no-tax zone and expand rebate benefits under Section 87A, while the Old Regime continues as an alternative for those who want to claim traditional deductions and exemptions.

In this blog, we’ll explain:

✔ Income tax slabs for AY 2026-27

✔ Differences between New vs. Old tax regimes

✔ What is Section 87A rebate and how it works

✔ How to calculate tax with examples

✔ Other exemptions & deductions

✔ FAQs (Frequently Asked Questions)

1. What is AY 2026-27?

The Assessment Year (AY) 2026-27 refers to the period from 1 April 2026 to 31 March 2027, during which your income earned from 1 April 2025 to 31 March 2026 (Financial Year 2025-26) is assessed for tax purposes.

2. Income Tax Slabs for AY 2026-27

Income Tax Regimes Comparison

The Income Tax Act allows individuals and Hindu Undivided Families (HUFs) to choose between two tax regimes

Taxpayers can opt for either the New Tax Regime with lower rates but fewer deductions, or the Old Tax Regime with higher rates but more deductions. The choice depends on individual financial circumstances and eligibility for deductions.

New Tax Regime

Optional — Lower rates, fewer deductions

Under the updated tax structure, the New Regime offers lower tax rates across more slabs, expanding the no-tax limit and combining it with a stronger rebate limit so that many taxpayers pay zero tax up to ₹12 lakh (before standard deductions).

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Note: Health & Education Cess @ 4% on income tax, plus applicable surcharge.

Old Tax Regime

Optional — Higher rates, more deductions

The old tax regime remains unchanged. It allows taxpayers to claim deductions such as Section 80C (up to ₹1.5 lakh), 80D (health insurance), HRA, home loan interest, etc., and then pay tax at the slabs below:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Note: Senior citizen slabs differ slightly (higher basic limits), but for simplicity this shows general structure. Health & Education Cess @ 4% applies.

The Income Tax Act allows individuals and Hindu Undivided Families (HUFs) to choose between two regimes:

A) New Tax Regime (Optional — Lower rates, fewer deductions)

Under the updated tax structure, the New Regime offers lower tax rates across more slabs, expanding the no-tax limit and combining it with a stronger rebate limit so that many taxpayers pay zero tax up to ₹12 lakh (before standard deductions).

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Health & Education Cess @ 4% on income tax, plus applicable surcharge.

B) Old Tax Regime (Optional — Higher rates, more deductions)

The old tax regime remains unchanged. It allows taxpayers to claim deductions such as Section 80C (up to ₹1.5 lakh), 80D (health insurance), HRA, home loan interest, etc., and then pay tax at the slabs below:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Senior citizen slabs differ slightly (higher basic limits), but for simplicity this shows general structure. Health & Education Cess @ 4% applies.

3. What is Section 87A Rebate?

A) Under New Tax Regime (115BAC)

The Government has raised the Section 87A rebate to a maximum of ₹60,000 for AY 2026-27. This means:

✔ If your total taxable income ≤ ₹12 lakh, your tax bill (before cess) can be reduced by up to ₹60,000, effectively taking your tax payable to zero.

After applying 87A rebate, zero tax is effectively levied up to ₹12 lakh.

For salaried individuals, after a standard deduction of ₹75,000 — you can remain tax-free up to an income of ₹12.75 lakh!

⚠️ Important Note: This rebate applies only to tax computed on normal income and doesn’t apply to special-rate incomes such as short-term capital gains (STCG) and long-term capital gains (LTCG) under the new regime.

B) Under Old Tax Regime

In the old regime, the Section 87A rebate continues as before:

✔ If taxable income ≤ ₹5 lakh, a rebate of up to ₹12,500 is allowed — reducing tax to nil, before cess.

4. How Tax is Calculated: Step-by-Step Examples

Let’s look at real numbers to understand how these rebates and slabs work.

Example A — New Tax Regime

Mr. Kumar has a salary of ₹12,50,000 (no other income).

Gross Income: ₹12,50,000

Standard Deduction: ₹75,000

→ Taxable Income = ₹11,75,000Tax before rebate

Upto ₹4,00,000 → Nil

₹4,00,001–₹8,00,000 @5% = ₹20,000

₹8,00,001–₹11,75,000 @10% = ₹37,500

→ Tax = ₹57,500

Rebate under Section 87A (max ₹60,000) = ₹57,500

→ Final Tax Payable = ₹0Cess @4% on tax (₹0) = ₹0

→ Total Tax = ₹0

👉 Result: Mr. Kumar pays zero tax! (This is a real benefit introduced from AY 2026-27.)

Example B — Old Tax Regime

Ms. Singh’s taxable income after deductions = ₹4,80,000.

Tax payable:

Upto ₹2,50,000 → Nil

₹2,50,001–₹4,80,000 @5% = ₹11,500

Rebate under Section 87A (Old) up to ₹12,500 applies → ₹11,500

→ Tax becomes ₹0Cess @4% = ₹0

📌 Result: Even in old regime, Ms. Singh pays zero tax due to 87A rebate.

Example C — Capital Gains + Salary

Here’s a trickier scenario: Mr. Reddy earns:

Salary after standard deduction: ₹10 lakh

LTCG (above ₹1,25,000 exemption limit): ₹3 lakh

STCG (short-term gains): ₹1 lakh

Under new regime, rebate may not extend to STCG & LTCG at special rates, so he may pay tax on those portions separately, while normal income under ₹12 lakh can still attract Section 87A rebate. 💡 (Many taxpayers and practitioners discuss this complexity — practical outcomes depend on components that are taxed at normal slabs vs. special rates.)

5. New Regime vs Old Regime: Which is Better?

Tax Regimes Feature Comparison

Detailed comparison of key features between the New Tax Regime and Old Tax Regime to help you make an informed decision

- Section 80C (up to ₹1.5 lakh)

- Section 80D (health insurance)

- HRA (House Rent Allowance)

- Home loan interest, etc.

6. Other Exemptions & Deductions

Standard Deductions

✔ Salaried taxpayers — ₹75,000

✔ Family pensioners — ₹25,000

Common Old Regime Deductions

✔ 80C — Investments up to ₹1.5 lakh

✔ 80D — Health insurance premiums

✔ 80TTA/80TTB — Interest on savings accounts

✔ HRA — House Rent Allowance

✔ Home loan interest under Section 24(b)

These deductions can make the old regime attractive if you have enough eligible investments/expenses.

7. How Health & Education Cess and Surcharge Work

After tax is computed:

✔ Health & Education Cess — 4% on income tax + surcharge

✔ Surcharge on high incomes (above ₹50 lakh) under new regime:

₹50 lakh–₹1 cr → 10%

₹1 cr–₹2 cr → 15%

₹2 cr–₹5 cr → 25% (capped)

Above ₹5 cr → 25% (capped)

8. Quick Tax Calculator Example

Let’s simply look at how your tax changes across incomes under the new regime:

| Taxable Income | Tax Payable (before 87A) | After 87A Rebate |

|---|---|---|

| ₹8,00,000 | ₹25,000 | ₹0 |

| ₹10,00,000 | ₹45,000 | ₹0 |

| ₹12,00,000 | ₹65,000 | ₹5,000 (Rebate capped at ₹60,000) |

| ₹14,00,000 | ₹95,000 | ₹35,000 |

✨ This illustrates how 87A rebate slices away liability up to ₹60,000.

9. Common Pitfalls & Rules

✔ 87A rebate does not apply to incomes taxed at special rates (like STCG/LTCG) under the new regime.

✔ Choosing the wrong regime without computing benefits can increase your tax.

✔ If your normal income is just under ₹12 lakh but total income above due to gains, rebate rules may vary — careful calculation is important.

FAQs on Income Tax Slab AY 2026-27

Q1. What is the basic exemption limit for AY 2026-27?

Under the new regime, the basic exemption limit is ₹4,00,000. Under the old regime, it remains ₹2,50,000 for most individuals.

Q2. What is Section 87A rebate and who can claim it?

Section 87A rebate allows eligible individuals to reduce their tax liability. For AY 2026-27:

✔ New Regime — Rebate up to ₹60,000 for incomes ≤ ₹12 lakh (tax before rebate).

✔ Old Regime — Rebate up to ₹12,500 for incomes ≤ ₹5 lakh.

Q3. Does 87A apply to capital gains?

Generally no — for AY 2026-27, Section 87A rebate doesn’t apply to incomes taxed at special rates like STCG and LTCG under the new regime.

Q4. Do I have to choose between new and old regime?

Yes — while new regime is default in some cases, you can opt for old regime while filing your ITR if it results in less tax after deductions.

Q5. What if my tax (before rebate) is less than ₹60,000?

Under new regime, if your tax is ≤ ₹60,000 and you qualify (total income ≤ ₹12 lakh), your final tax payable could be zero after rebate.

Q6. Are there exemptions in the new regime?

The new regime allows limited exemptions — mainly:

✔ Standard deduction (₹75,000)

✔ Employer NPS contributions (up to 14%)

✔ Some others — but most traditional exemptions are removed.

Conclusion :-

The Income Tax Slab for AY 2026-27 brings a simpler — and in many cases lighter — tax burden, especially under the New Tax Regime. With the Section 87A rebate hiked to ₹60,000, millions earning up to ₹12 lakh can enjoy zero tax liability after rebate and deductions. Meanwhile, the Old Regime remains useful if you have many eligible deductions and exemptions to claim.

💡 Tip: Always compute tax under both regimes before filing your ITR — whichever gives you lower tax payable should be chosen.