Table of Contents

ToggleUnderstanding Your Income Tax Refund Status: A Simple Guide

Figuring out your income tax refund status can be confusing. Many people wait eagerly for their refunds but aren’t sure how to check where they are in the process. This guide will help you understand what income tax refund status means and how to track it easily.

What is an Income Tax Refund?

An income tax refund happens when you’ve paid more tax during the year than you owe. This can happen for several reasons, like tax deductions or credits. When this happens, the government gives back the extra money you paid. Knowing your income tax refund status helps you see when you might get this money back and plan your finances better.

To track your income tax refund status, you need to file your tax return correctly and on time. Once you’ve filed, the process to issue a refund begins. Tracking your income tax refund status lets you know where you are in this process.

How to Check Your Income Tax Refund Status?e

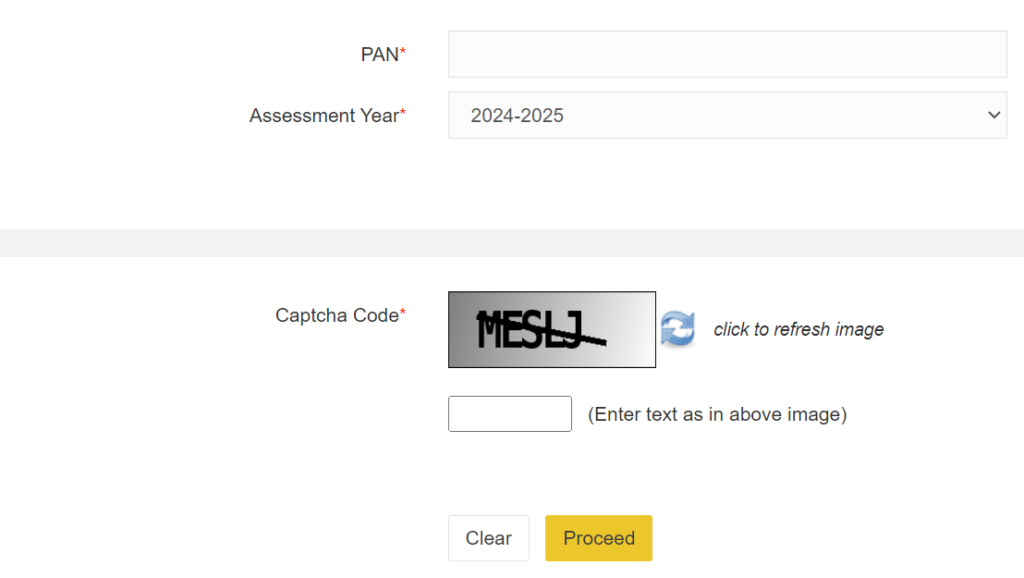

Checking your income tax refund status is simple. Many countries have online portals where you can log in and see your refund status. For example, in the United States, the IRS has a tool called “Where’s My Refund?” on their website and mobile app. In India, you can check on the Income Tax Department’s e-filing portal.

To check your income tax refund status, you usually need your PAN (Permanent Account Number), the assessment year, and the acknowledgment number from your tax return. Once you’re logged in, you can see the status of your refund. The status might show as “Return Received,” “Refund Approved,” or “Refund Sent,” each meaning a different stage in the refund process.

Sometimes, refunds can be delayed due to errors in the filed return, extra verification needs, or backlogs at the tax department. Keeping an eye on your income tax refund status helps you stay updated and act quickly if there are any issues.

Common Issues and How to Fix Them:

Even though checking your income tax refund status is easy, problems can arise. One common issue is when there are mistakes in the tax return that need extra checking by the tax authorities. If the details don’t match the records, your refund might be delayed. You might get a notice asking for more information or documents.

Another issue could be incorrect bank details on the tax return. If your refund is processed but the bank details are wrong, the money won’t reach your account. Always double-check your bank details before submitting your tax return. If you find a mistake after submitting, inform the tax authorities right away to correct it.

If your status shows “Refund Sent” but you haven’t received the money, there might be a delay at the bank. In this case, contact your bank for more information. Also, make sure your contact details, like email and phone number, are updated in the tax records so you get timely updates about your income tax refund status.

The Importance of Filing on Time and Providing Accurate Information

Filing your tax return on time and accurately is crucial for getting your refund quickly. If you file your return before the deadline, your refund will be processed sooner. Late filing can cause delays and penalties, affecting your refund.

Accuracy is also important for a smooth refund process. Double-check all the details, such as your PAN, bank details, and income declarations, before submitting your return. Mistakes can cause delays in your income tax refund status. Using good tax preparation software or consulting a tax professional can help ensure everything is correct.

Knowing your income tax refund status helps you plan your finances. It allows you to know when to expect your refund and handle any issues promptly.

Tips for a Smooth Refund Process

Here are some tips to ensure you get your refund smoothly and on time:

File Early: Submitting your tax return early can lead to faster processing and a quicker refund.

Accurate Information: Double-check all the details on your return to avoid mistakes that could delay your refund.

E-File: Filing electronically is faster and reduces errors compared to paper filing.

Direct Deposit: Choose direct deposit for your refund. It’s faster and more secure than getting a check by mail.

Track Your Refund: Regularly check your income tax refund status using the online portal provided by the tax authorities. This helps you stay updated and act if there are any issues.

Keep Records: Keep copies of your tax return, acknowledgment receipt, and any communication with the tax authorities. These can be useful if there are discrepancies or delays in your refund.

Conclusion

Understanding and tracking your income tax refund status is important for managing your money. It helps you know when to expect your refund and deal with any issues quickly. By following these tips and staying proactive, you can ensure a smooth refund process.

Remember, your income tax refund is your money being returned to you. Tracking your income tax refund status makes sure you get it without unnecessary delays. Whether you’re planning a major expense, building an emergency fund, or investing, getting your refund on time can make a big difference in your financial planning.

In summary, the key to a smooth refund process is timely and accurate filing, regular tracking of your income tax refund status, and quick action on any issues. By staying informed and proactive, you can handle the tax refund process easily and make sure your refund reaches you quickly.

Very Informative..

Hey people!!!!!

Good mood and good luck to everyone!!!!!