Table of Contents

ToggleFrom NPS to UPS: How Will It Impact Your Retirement?

What is the difference between NPS and UPS?

Who will benefit the most from the transition to UPS?

How will UPS impact your post-retirement financial security?

Why is the government introducing the Unified Pension Scheme (UPS)?

Retirement planning is a crucial aspect of financial security, and the introduction of the Unified Pension Scheme (UPS) marks a significant shift from the National Pension System (NPS). With the government rolling out UPS from April 1, 2025, central government employees covered under NPS now have the option to transition to this new system, which ensures an assured payout post-retirement. But how does UPS compare to the Old Pension Scheme (OPS) and the existing NPS? Let’s analyze the key differences and their impact on your retirement.

Understanding the Transition: From NPS to UPS

The National Pension System (NPS) was introduced as a market-linked pension plan, where contributions made by employees and the government were invested in a mix of equity and debt instruments. The returns under NPS were not fixed, leading to uncertainties regarding post-retirement income. To address these concerns, the government has introduced Unified Pension Scheme (UPS), which guarantees a fixed payout.

Under UPS, retirees will receive an assured pension of 50% of their last 12-month average basic pay if they have served a minimum of 25 years. If the service period is less than 25 years but more than 10 years, retirees will receive a minimum guaranteed payout of Rs. 10,000 per month, provided they have made regular contributions without withdrawals.

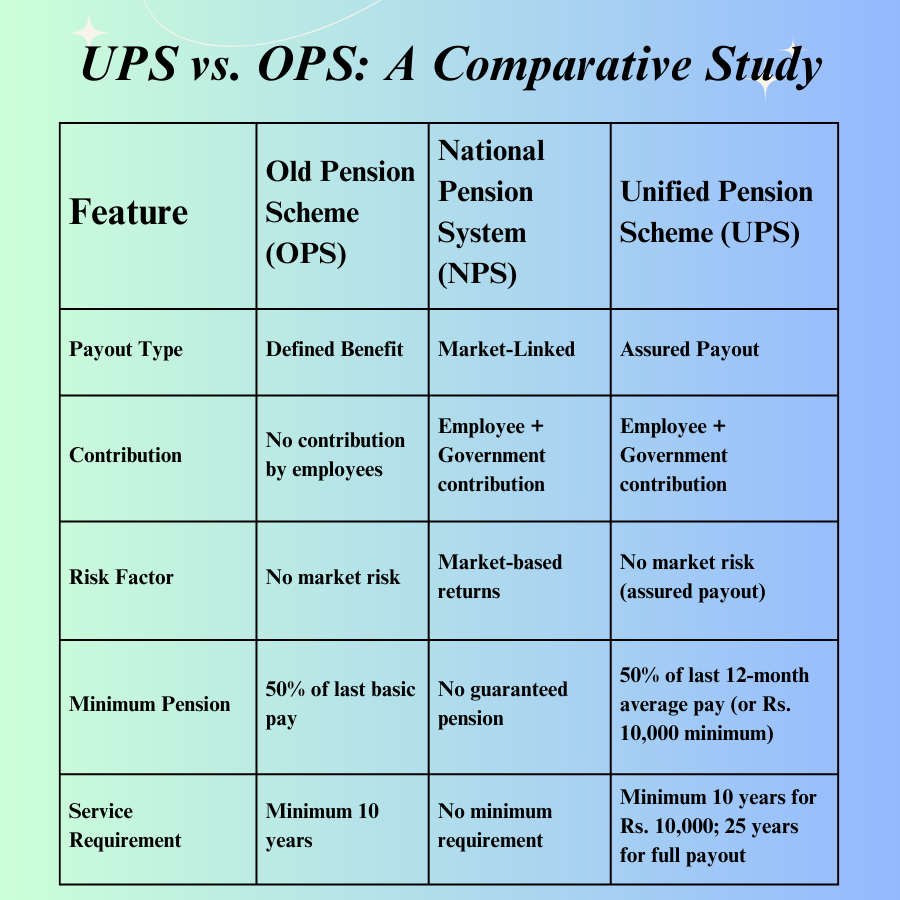

UPS vs. OPS: A Comparative Study

Before the introduction of NPS, government employees were covered under the Old Pension Scheme (OPS), which provided a defined benefit pension calculated as 50% of the last drawn salary. It was fully funded by the government without requiring employee contributions.

The UPS, in comparison, still requires both employee and employer contributions (like NPS), but ensures a minimum payout similar to the OPS. Here’s how OPS, NPS, and UPS compare:

Feature | Old Pension Scheme (OPS) | National Pension System (NPS) | Unified Pension Scheme (UPS) |

|---|---|---|---|

| Payout Type | Defined Benefit | Market-Linked | Assured Payout |

| Contribution | No contribution by employees | Employee + Government contribution | Employee + Government contribution |

| Risk Factor | No market risk | Market-based returns | No market risk (assured payout) |

| Minimum Pension | 50% of last basic pay | No guaranteed pension | 50% of last 12-month average pay (or Rs. 10,000 minimum) |

| Service Requirement | Minimum 10 years | No minimum requirement | Minimum 10 years for Rs. 10,000; 25 years for full payout |

The introduction of UPS aims to provide a stable income in retirement while still being a fund-based system that requires regular employee and employer contributions.

How Will UPS Impact Your Retirement?

Financial Security with Assured Payout

One of the biggest concerns with NPS was market volatility, which could affect the corpus available for post-retirement income. With UPS, retirees will now have predictable financial security with a guaranteed payout.Hybrid of NPS and OPS

The UPS is not a return to OPS but a middle ground between OPS and NPS. Unlike OPS, it still requires employee contributions, but unlike NPS, it guarantees a fixed pension amount.Minimum Pension Benefit

Those retiring with at least 10 years of service will receive a minimum pension of Rs. 10,000 per month, which wasn’t available under NPS. This ensures a financial safety net for employees who might have had shorter service periods.Impact on Government Finances

The return of assured pensions might increase financial liability for the government compared to the market-driven NPS. However, since it still remains fund-based, the burden will be shared between the employee and employer contributions.Retirement Planning Becomes Simpler

With NPS, employees had to carefully plan their withdrawals and invest wisely post-retirement to ensure a steady income. UPS eliminates this uncertainty by providing a predefined monthly pension, making retirement planning much simpler.

Frequently Asked Questions (FAQs) about "From NPS to UPS"

1. What is the difference between NPS and UPS?

The National Pension System (NPS) is a market-linked pension scheme where both employees and the government contribute, and returns depend on market performance. The Unified Pension Scheme (UPS), on the other hand, guarantees a fixed payout based on the last 12-month average basic pay, ensuring stability and financial security post-retirement.

2. Who is eligible for UPS?

Only central government employees currently under NPS are eligible to opt for UPS. The transition is voluntary, and employees must meet the required service period to receive the assured payout.

3. How does the assured payout under UPS work?

Employees with 25 years of service will receive a pension of 50% of their last 12-month average basic pay. Employees with 10 years or more of qualifying service will receive a minimum of Rs. 10,000 per month, provided they have made regular contributions without withdrawals.

4. What happens if an employee voluntarily retires under UPS?

If an employee opts for voluntary retirement after 25 years of service, the assured payout will commence from the date they would have superannuated had they continued in service.

5. How does UPS compare to the Old Pension Scheme (OPS)?

Unlike OPS, which was fully funded by the government, UPS still requires employee contributions but guarantees a fixed pension amount. UPS acts as a middle ground between the risk-based NPS and the government-funded OPS.

6. Will UPS impact government finances?

Since UPS remains a fund-based system, it does not entirely replicate OPS. However, it reduces market-related risks and ensures financial security for retirees while balancing financial liabilities for the government.

7. Should I switch from NPS to UPS?

If you prefer a fixed pension payout rather than a market-linked return, UPS is a more secure option. It particularly benefits those with longer service tenure, ensuring financial stability post-retirement.

The transition from NPS to UPS is a crucial decision for government employees. Evaluating financial goals, service tenure, and future security is essential before making a choice. With UPS becoming operational from April 1, 2025, employees should carefully analyze its benefits and opt for what aligns best with their retirement plans.

Conclusion:From NPS to UPS: How Will It Impact Your Retirement?

The transition from NPS to UPS brings a significant shift in retirement planning for government employees. While it does not fully restore OPS, it mitigates the risk of market fluctuations under NPS by ensuring a stable and predictable pension payout. With its assured pension structure, UPS is poised to become a preferred choice for government employees seeking financial stability post-retirement.

As the Unified Pension Scheme (UPS) becomes operational from April 1, 2025, government employees should carefully evaluate their options and make an informed decision about opting for UPS over NPS. While the new scheme does not entirely replicate the benefits of OPS, it certainly provides a more secure alternative to the market-linked NPS, making retirement planning easier and more predictable.