Table of Contents

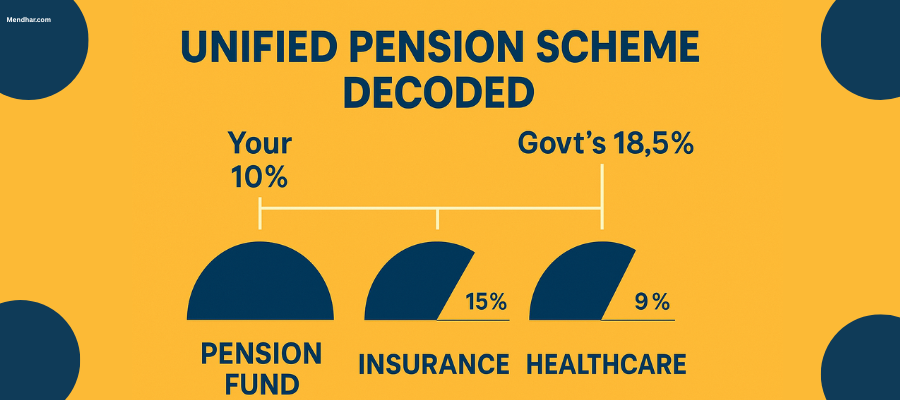

ToggleUPS Decoded: Where Does Your 10% + Govt's 18.5% Actually Go?

The Indian government has introduced the Unified Pension Scheme (UPS) as an optional alternative under the National Pension System (NPS) for Central Government employees. This landmark reform aims to provide guaranteed pension benefits while maintaining a contributory structure. But how exactly does this system function? Where does your 10% salary contribution and the government’s 18.5% matching contribution get allocated?

This comprehensive guide breaks down the UPS framework, explains the fund flow mechanism, and helps you understand whether this scheme aligns with your retirement planning needs.

Understanding the UPS Contribution Structure

Under the Unified Pension Scheme (UPS), the contributions are split into two separate funds:

Individual Corpus – Funded by your 10% contribution and the government’s matching 10%.

Pool Corpus – Funded by an additional 8.5% contribution from the government.

Here’s how it works:

1. Your 10% + Govt’s 10% = Individual Corpus

You contribute 10% of your (Basic Pay + DA) every month.

The government adds another 10% as matching contribution.

This 20% total goes into your individual corpus, which you can invest as per your choice (or a default option).

2. Govt’s Extra 8.5% = Pool Corpus

The government contributes an additional 8.5% of (Basic Pay + DA).

This goes into a common pool corpus, managed by the government.

This pool helps fund the assured pension payouts for all employees under UPS.

Where Does the Money Go at Retirement?

At retirement, your individual corpus is compared to a benchmark corpus (calculated based on default investment returns). Here’s what happens:

If your individual corpus ≥ benchmark, you transfer the benchmark amount to the pool corpus and get the full assured pension. Any excess is paid to you as a lump sum.

If your individual corpus < benchmark, you get a reduced pension proportional to the shortfall.

Key Features of UPS Payouts

✅ Minimum 10 years of service required for any pension.

✅ Full pension (50% of last drawn basic pay) after 25+ years of service.

✅ Proportional pension for less than 25 years.

✅ Minimum guaranteed pension of ₹10,000/month (if service ≥ 10 years).

✅ Family pension (60%) for the spouse after the employee’s death.

✅ Dearness Relief (DR) adjustment on pension.

✅ Lump sum payment at retirement = 10% of (Basic + DA) × every 6 months of service.

FAQs on UPS (Unified Pension Scheme)

1. Who is eligible for UPS?

Central Government employees under NPS who opt for UPS.

Employees with minimum 10 years of service.

2. What if I resign or am dismissed?

No assured pension—only your accumulated NPS corpus will be available.

3. How is the pension calculated?

Full pension = 50% of last 12-month average basic pay (after 25+ years).

Proportionate pension for fewer years.

Minimum ₹10,000/month if service ≥ 10 years.

4. Can I withdraw money before retirement?

Partial withdrawals are allowed but may reduce your final pension if not recouped.

5. What happens if my investments underperform?

If your individual corpus is less than benchmark, your pension gets reduced proportionately.

6. Is UPS better than the old pension scheme (OPS)?

UPS is market-linked but offers assured payouts, unlike pure NPS.

OPS was fully government-funded, but UPS requires employee contributions.

7. Can past NPS retirees opt for UPS?

Yes, but they will get arrears with PPF interest rates.

Conclusion: Is UPS a Good Deal?

The Unified Pension Scheme (UPS) represents a middle ground between the Old Pension Scheme (OPS) and the market-linked NPS.

Advantages of UPS:

✔ Assured monthly pension (unlike pure NPS).

✔ Government-backed safety net via the pool corpus.

✔ Flexibility in investment choices for the individual corpus.

Potential Drawbacks:

✖ Lower pension than OPS for those with <25 years of service.

✖ Market risks if investments underperform.

Final Verdict:

If you are a Central Government employee, UPS provides a more secure alternative to standard NPS. However, those seeking higher returns may prefer sticking with NPS equity investments.

Evaluate your risk appetite, service duration, and retirement goals before opting for UPS.