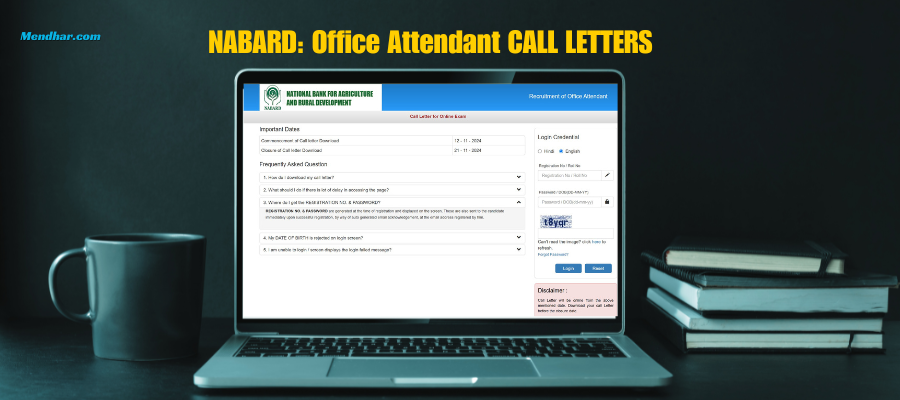

NABARD: Call Letters for Office Attendant Exam

NABARD: Call Letters for Office Attendant Exam: Important Dates and Call Letter Download Details Facebook Wordpress Twitter Wordpress The NABARD: Call Letters for Office Attendant Exam: Important Dates and Call Letter Download Details guide provides essential information for all candidates preparing for the NABARD Office Attendant Exam. This opportunity within the prestigious National Bank for […]

NABARD: Call Letters for Office Attendant Exam Read More »