Income Tax Slab Rates as per Budget 2026 for AY 2027-28

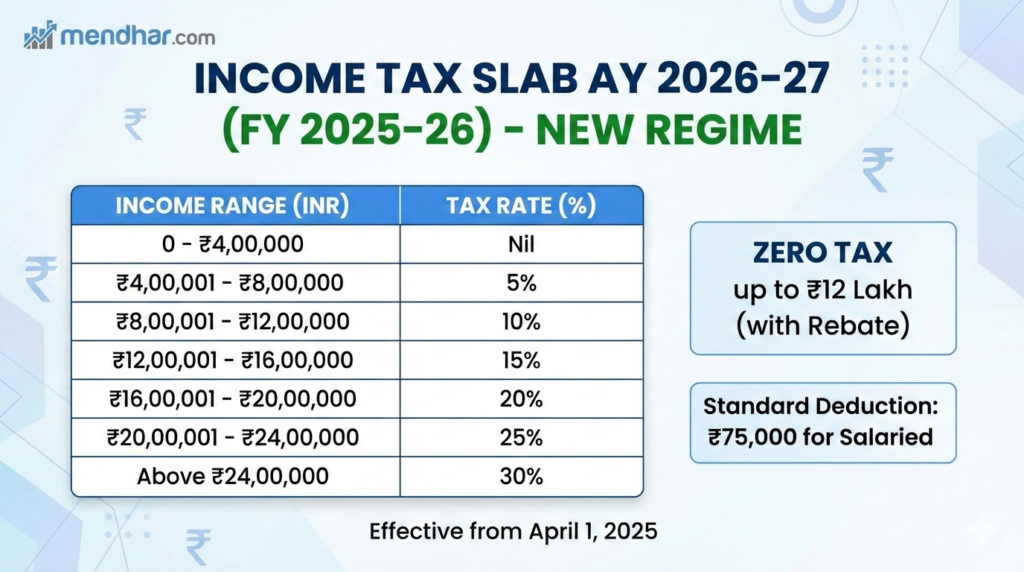

Income Tax Slab Rates as per Budget 2026 for AY 2027-28 – Complete Guide Facebook Wordpress Twitter Wordpress Understanding income tax slab rates as per Budget 2026 for AY 2027-28 is critical for every taxpayer in India — whether you are a salaried employee, a business owner, a professional, or an investor. In this detailed […]

Income Tax Slab Rates as per Budget 2026 for AY 2027-28 Read More »