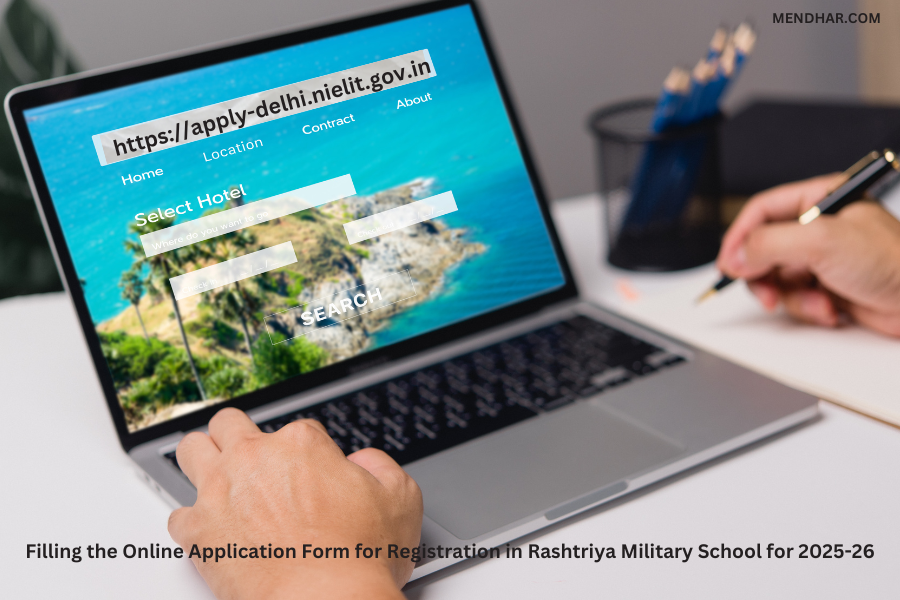

How to Fill the RMS Selection Test Form Online

Comprehensive Guide:How to Fill the RMS Selection Test Form Online Facebook Wordpress Twitter Wordpress If you’re looking to enroll your child in Rashtriya Military Schools (RMS), the selection process begins with completing the RMS selection test form online. This guide will walk you through the entire process step-by-step, ensuring that you know exactly what to […]

How to Fill the RMS Selection Test Form Online Read More »