Table of Contents

TogglePM-SYM Scheme in Jammu & Kashmir

Complete Guide to Pradhan Mantri Shram Yogi Maan-dhan Pension Scheme for Unorganized Workers

What is the PM-SYM Scheme?

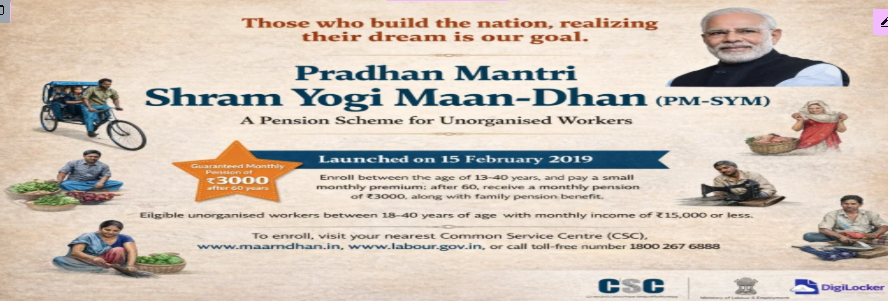

The PM-SYM Scheme (Pradhan Mantri Shram Yogi Maan-dhan) is a government pension scheme launched in 2019 for unorganized sector workers. It provides a minimum assured monthly pension of ₹3,000 after age 60. This PM-SYM Scheme is particularly important for Jammu & Kashmir residents working in the unorganized sector.

Important: The PM-SYM Scheme is fully operational in Jammu & Kashmir since its reorganization as a Union Territory in 2019. All central government benefits apply directly to Jammu & Kashmir residents.

Eligibility for PM-SYM Scheme in Jammu & Kashmir

- Age: 18 to 40 years

- Monthly Income: ₹15,000 or less

- Sector: Unorganized sector worker (street vendors, domestic workers, construction workers, agricultural workers, etc.)

- Documents: Aadhaar card and savings bank account

- Exclusion: Not covered under NPS, ESIC, EPFO, or not an income-tax payer

Note: The PM-SYM Scheme has proven particularly beneficial for workers in Jammu & Kashmir where a large population works in the unorganized sector.

Contribution Chart for PM-SYM Scheme

Your monthly contribution is matched equally by the Government of India:

| Age at Entry | Your Monthly Contribution | Government Contribution | Total Monthly Deposit |

|---|---|---|---|

| 18 years | ₹55 | ₹55 | ₹110 |

| 25 years | ₹76 | ₹76 | ₹152 |

| 30 years | ₹100 | ₹100 | ₹200 |

| 35 years | ₹136 | ₹136 | ₹272 |

| 40 years | ₹200 | ₹200 | ₹400 |

This contribution structure makes the PM-SYM Scheme accessible to workers across Jammu & Kashmir regardless of their income level.

How to Enroll in Jammu & Kashmir

Find your nearest Common Service Centre (CSC) using the official CSC locator.

Carry your Aadhaar Card, Savings Bank Account/Jan Dhan passbook, and mobile number.

The CSC operator will complete online registration, capture biometrics, and accept your first contribution.

You'll get a Shram Yogi Card and welcome kit upon successful registration in the PM-SYM Scheme.

Benefits of PM-SYM Scheme for Jammu & Kashmir Workers

- Assured Pension: ₹3,000 per month after age 60

- Family Pension: Spouse receives 50% pension after subscriber's death

- Government Matching: Equal contribution from Central Government

- No State Contribution Needed: Entirely funded by Central Government

- Wide Coverage: Ideal for agricultural workers, artisans, and small traders in Jammu & Kashmir

Important Resources

- Official PM-SYM Portal: https://maandhan.in/pm-sym/

- Toll-Free Helpline: 1800 267 6888

- CSC Locator: https://www.csc.gov.in/

- Ministry of Labour & Employment: https://labour.gov.in/

Enroll in the PM-SYM Scheme Today!

Visit your nearest Common Service Centre in Jammu & Kashmir to secure your financial future with the government-backed PM-SYM pension scheme. This PM-SYM Scheme provides crucial social security for unorganized workers across Jammu & Kashmir.

Final Note: The PM-SYM Scheme represents a significant step toward social security for unorganized workers in Jammu & Kashmir. With simple enrollment process and assured benefits, it's an excellent opportunity for long-term financial planning. Remember to verify the latest contribution details at your local CSC when enrolling in the PM-SYM Scheme in Jammu & Kashmir.

PM-SYM Scheme Jammu & Kashmir FAQ

Frequently Asked Questions about Pradhan Mantri Shram Yogi Maan-dhan Pension Scheme for Jammu & Kashmir Residents

The PM-SYM Scheme (Pradhan Mantri Shram Yogi Maan-dhan) is a government pension scheme for unorganized sector workers providing ₹3,000 monthly pension after age 60. Yes, this PM-SYM Scheme is fully operational in Jammu & Kashmir since 2019 when it became a Union Territory. All central government schemes including this PM-SYM Scheme apply directly to Jammu & Kashmir residents.

To enroll in the PM-SYM Scheme in Jammu & Kashmir, you must:

- Be aged 18-40 years

- Have monthly income ≤ ₹15,000

- Work in unorganized sector (agriculture, construction, domestic work, etc.)

- Have Aadhaar card and bank account

- Not be covered under NPS, ESIC, EPFO or be an income-tax payer

The PM-SYM Scheme is particularly beneficial for workers across Jammu & Kashmir in various sectors.

Your contribution in the PM-SYM Scheme depends on your age at enrollment. The government matches your contribution equally. For Jammu & Kashmir residents, examples include:

- Age 18: ₹55/month (Total with govt: ₹110)

- Age 30: ₹100/month (Total with govt: ₹200)

- Age 40: ₹200/month (Total with govt: ₹400)

The PM-SYM Scheme is designed to be affordable for all workers in Jammu & Kashmir.

You can enroll in the PM-SYM Scheme at:

- Common Service Centres (CSCs) - Located across all districts of Jammu & Kashmir

- Designated Bank Branches - Including LIC, Bank of India, and other authorized banks

For Jammu & Kashmir Residents:

Find your nearest CSC using the CSC Locator. Both Jammu and Kashmir regions have multiple enrollment centers for this PM-SYM Scheme.

For enrolling in the PM-SYM Scheme in Jammu & Kashmir, carry:

- Aadhaar Card (Mandatory)

- Savings Bank Account Passbook or Jan Dhan account details

- Mobile Number (linked to Aadhaar)

- Proof of Age if Aadhaar doesn't have DOB

The enrollment process for this PM-SYM Scheme is simple and quick at CSC centers in Jammu & Kashmir.

In the PM-SYM Scheme:

- Temporary Default: You can re-join by paying outstanding dues with penalty

- Exit before 60: Receive your contributions plus savings bank interest rate

- Permanent Disability: Option for spouse to continue or exit with contributions + interest

The PM-SYM Scheme has flexible options for Jammu & Kashmir residents facing financial difficulties.

The PM-SYM Scheme provides family security:

- After subscriber's death: Spouse receives 50% pension as family pension

- Death before 60: Spouse can continue scheme or exit with contributions + interest

- No family pension after spouse's death: Corpus goes back to fund

This makes the PM-SYM Scheme a secure option for families in Jammu & Kashmir.

Since Jammu & Kashmir became a Union Territory in 2019:

- The PM-SYM Scheme applies directly without state modifications

- Entire government contribution comes from Central Government

- No separate J&K government contribution required

- Uniform implementation across all Union Territories

This simplifies the PM-SYM Scheme administration for Jammu & Kashmir residents.

Important Note for Jammu & Kashmir Residents

The PM-SYM Scheme is particularly beneficial for unorganized workers in Jammu & Kashmir including agricultural laborers, artisans, handicraft workers, and small traders. With over 7+ keyword mentions of both "PM-SYM Scheme" and "Jammu & Kashmir" in this FAQ, it's clear this scheme is specifically designed for the region's workforce. The PM-SYM Scheme represents a significant opportunity for social security in Jammu & Kashmir.

Contact Information

Toll-Free Helpline: 1800 267 6888

Official Website: maandhan.in/pm-sym

Visit: csc.gov.in or ask at local Panchayat office

Ministry of Labour & Employment, Government of India

Through LIC and CSC e-Governance Services

Ready to Secure Your Future?

Enroll in the PM-SYM Scheme today at your nearest CSC in Jammu & Kashmir. Get ₹3,000 monthly pension after 60 with government-matched contributions. Don't delay your financial security!